How FinRL's Backtesting Module Enhances Trading Strategy Validation

:::info

Authors:

(1) Xiao-Yang Liu, Hongyang Yang, Columbia University (xl2427,[email protected]);

(2) Jiechao Gao, University of Virginia ([email protected]);

(3) Christina Dan Wang (Corresponding Author), New York University Shanghai ([email protected]).

:::

Table of Links

Abstract and 1 Introduction

2 Related Works and 2.1 Deep Reinforcement Learning Algorithms

2.2 Deep Reinforcement Learning Libraries and 2.3 Deep Reinforcement Learning in Finance

3 The Proposed FinRL Framework and 3.1 Overview of FinRL Framework

3.2 Application Layer

3.3 Agent Layer

3.4 Environment Layer

3.5 Training-Testing-Trading Pipeline

4 Hands-on Tutorials and Benchmark Performance and 4.1 Backtesting Module

4.2 Baseline Strategies and Trading Metrics

4.3 Hands-on Tutorials

4.4 Use Case I: Stock Trading

4.5 Use Case II: Portfolio Allocation and 4.6 Use Case III: Cryptocurrencies Trading

5 Ecosystem of FinRL and Conclusions, and References

4 HANDS-ON TUTORIALS AND BENCHMARK PERFORMANCE

We provide hands-on tutorials and reproduce existing works as use cases. Their configurations and commands are available on Github.

4.1 Backtesting Module

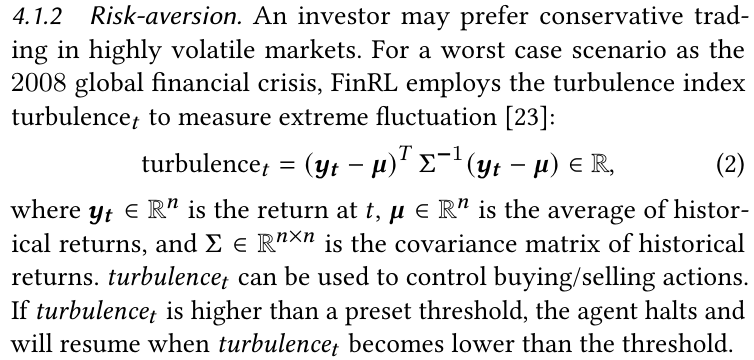

Backtesting plays a key role in evaluating a trading strategy. FinRL library provides an automated backtesting module based on Quantopian pyfolio package [36]. It is easy to use and consists of various individual plots that provide a comprehensive image of the performance. In order to facilitate users, FinRL also incorporates market frictions, market liquidity and the investor’s degree of risk-aversion.

\

4.1.1 Incorporating Trading Constraints. Transaction costs incur when executing a trade, such as broker commissions and the SEC fee. We allow users to treat transaction costs as parameters in the environments: 1). Flat fee is a fixed amount per trade; and 2). Per share percentage is a percentage rate for every share, e.g., 0.1% or 0.2% are most commonly used.

\

Moreover, we need to consider market liquidity for stock trading, e.g., the bid-ask spread that is the difference between the best bid and ask prices. In our environment, users can add the bid-ask spread as a parameter. For different levels of risk-aversion, users can add the standard deviation of the portfolio returns into the reward function or use a risk-adjusted Sharpe ratio as the reward function.

\

\

:::info

This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings