Escaping the Payday Matrix: Ex-OpenAI & Opera Devs Code Financial Freedom for 1.4 Billion Unbanked

We live paycheck to paycheck, and to solve this problem, we have assassins trying to shoot the President. Not a good approach. Another answer is still in the works, made by an Avengers team of former OpenAI and Opera engineers. "Financial freedom for the billions of unbanked." In layman's terms: let people use their own money. Sounds pretty far-fetched, but the reality is that most people can't even use the money they've already earned. Not even borrowed money, their own money.

\

Services that we take for granted in the West will still be incredibly hard to come by in most parts of the world in 2024 - yet, they are essential. Small loans, sending money abroad, or even getting your salary on the day you earn it, rather than at the end of the week or month, or even at all. This is crucial because most people have no savings and are highly dependent on the lifeline that is their next paycheck.

\

Emergency savings has long been the Achilles heel of Americans’ personal finances. More households have no emergency savings and millions of households are far short of the savings they would need to feel comfortable. — Greg McBride, CFA , chief financial analyst for Bankrate

\

To do this, they're using sophisticated AI models to slice margins into tiny fractions and handle difficult geographies with high default rates, as well as a bespoke blockchain as a ledger.

\

\

Now, I know what you're thinking. 'This sounds like typical Silicon Valley hype-speak. Where's the beef?' Fair enough. Here's what we really want to know:

\

Blockchain as a ledger? Cool, but how does that actually work?

How exactly are these AI models performing their margin-slicing magic?

Who are the people behind this?

\

Before we get to those 3, let’s start with the motive, the vision. ‘The why’ if you will.

\

The $100 Trillion Problem: The global payroll market, valued at over $100 trillion annually, operates on an antiquated system that leaves billions financially vulnerable. For the over 1.4 billion completely unbanked individuals worldwide, traditional payroll isn't just inconvenient—it's a complete barrier to economic participation.

\

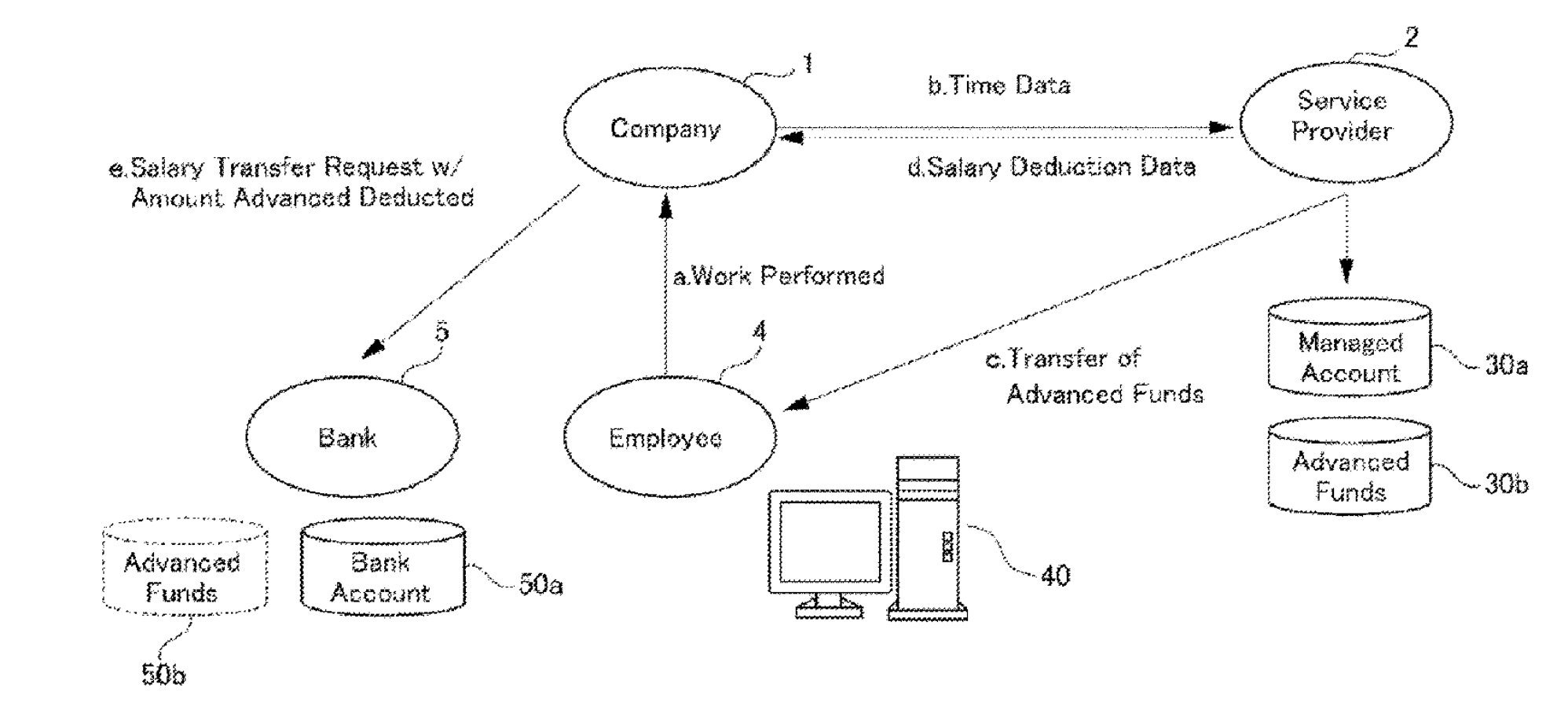

In the graphic above, we saw the structure of one of their core services addressing this very issue. It has been coined (and patented) EWA, or Earned Wage Access, and was first introduced to the international market by Volante Chain. Instead of a lump sum at the end, you can withdraw your salary for completed work at any time, giving you full control and flexibility. When, how often, and how much is up for you to decide.

\

For example, instead of the usual 100% of your salary at the end of the month, you could withdraw 10% after 3 days and receive the remaining 90% at the end. Considering the vast amount of people without any savings, this serves as a crucial lifeline for any unexpected expenses.

\

In addition, your track record as an employee, rather than a traditional credit score, is used to qualify you for better rates and even loans. You can also choose to be paid in stablecoins rather than your local FIAT currency (or partially in both). Very useful in the event of high inflation.

\

\

This doesn’t just affect the citizens of extreme cases, such as unstable war zones. Japan, for example, had a relatively stable $1 = ¥100 course for almost 3 decades. While it did fluctuate over the years, it usually took several quarters for the exchange rate to move in any meaningful dimension and never went beyond +/- 10%.

\

Then, over the course of just a few weeks, the yen crashed from $1 = ¥100 to a staggering $1 = ¥160. If you are ~30 years old like me, you have never seen anything like this in the chart.

\

\

Volante also offers fair transfers for money sent abroad, with an emphasis on “without paying exorbitant, unfair fees to third party services taking advantage of those left without other options.”

\

Let's look at the blockchain aspect. The reason why this type of record keeping was chosen is because of the functionality that smart contracts provide. Normally, you have banks, lawyers, accountants, and a bunch of other intermediaries between employers and employees.

\

In the case of Volante, all of that is cut out, with Volante essentially paying the employee and then being repaid by the employer. Transactions in the same fashion as the OG Bitcoin Whitepaper envisioned for peer-to-peer transactions.

\

\

For this purpose, Volante’s blockchain layer utilizes a modified Proof-of-Stake consensus mechanism with ZK-SNARKs for transaction privacy and smart contracts for wage distribution.

The AI Engine

From employee performance data including leave days and KPIs to company revenue projections, everything can be fed to the prediction algorithms to determine the corresponding rates. This drives down defaults and minimizes fees and margins on transactions.

\

Employs reinforcement learning for predictive financial modeling

Natural Language Processing for user interactions

Anomaly detection for fraud prevention

Secure data sets of the highest possible quality

Alternatives through functionality to keep compliance when otherwise not possible, e.g. limited data for KYC and proof of funds or credit scores

\

This is where the experience at Opera kicks in because all of this functionality would mean nothing if it wasn’t easy to use. To the employee, the entire infrastructure remains relatively unimportant. For them, the experience is kept as simple, convenient, and affordable as possible. Just like using the internet doesn’t require understanding how it works.

\

\

\

First-generation smartphones, fax machines, Windows 95, a pigeon with a paper on its leg. Backwards compatibility is taken to the extreme. In most cases, the interoperability will likely not need to go this far, but it can. According to their WhitePaper, Volante’s Chain uses:

\

Custom-built API layer for integration with traditional banking systems

Atomic swaps for cross-chain liquidity

Regulatory compliance module with real-time updates

A vast array of employer, finance, and merchant partners

\

The design choices reflect the usable-by-anyone vision. Rather than web3 or web2 users, this is more akin to anyone who can read, in favor of backward compatibility and interoperability with the computer illiterate.

\

\

"We're not just building a product; we're architecting a new financial paradigm that speaks both the language of cutting-edge tech and traditional finance." — Bertschler explains

\

The Unbanked Revolution

For the 1.4 billion unbanked individuals, Volante isn't just convenient—it's revolutionary. By providing a digital financial identity and instant access to earned wages, Volante opens doors to financial services previously out of reach.

\

\

Take, for instance, this case of a woman who had to rob a bank just to access her own life savings as a last means to pay for her sister’s medical bills.

Challenges and Future Outlook

Despite its potential and strong partners, Volante’s approach to banking the unbanked faces significant hurdles:

\

Regulatory compliance across jurisdictions

Integration with legacy financial systems

User adoption and education

\

\

"Every revolutionary advancement in financial technology has initially been met with skepticism," Valerias states. "Success demands more than optimistic projections; it requires collaboration with regulators and a pragmatic approach to implementation."

Conclusion

Whether Volante can deliver on its promises remains to be seen, but I, for one, can't wait for the first crypto transaction to be processed by Pigeon. As we stand on the brink of this financial revolution, one thing is clear: the future of money is being coded today.

\

Whether it's autonomous vehicles navigating physical spaces or blockchain systems redefining our financial landscape, the solutions of tomorrow are being architected by those who can successfully navigate the intersection of cutting-edge technology and human needs.

\

Volante's journey reminds us that while AI may soon drive us around, it's still human ingenuity that's steering us toward a more inclusive financial future.

\

\

\

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings