Billionaire Chase Coleman Just Made a Likely Once-in-a-Generation Bet on This Stock. Time to Buy?

Billionaire Chase Coleman of Tiger Global Management built his reputation by making correct calls on Facebook's parent Meta Platforms and Microsoft's LinkedIn.

More recently, he made what may be a once-in-a-generation bet on Southeast Asian conglomerate Sea Limited (NYSE: SE) after having sold most of his shares in 2022. Does that mean the troubled stock is ready for a comeback?

The state of Sea Limited

In retrospect, the initial optimism and past hesitation about his Sea Limited position appear understandable. When Coleman first took an interest in 2018, Sea Limited looked poised to capitalize on mobile gaming and online commerce in the populous emerging markets in Southeast Asia. The stock price rose dramatically over the next three years, particularly because pandemic-driven lockdowns increased interest in its offerings.

However, by 2022, conditions had changed, and not just because the end of lockdowns left people with less time for games and online shopping.

The decline in gaming worsened when the Indian government banned the company's popular Free Fire game in that country of more than 1.4 billion people. Moreover, its Shopee e-commerce division suffered setbacks when it quickly entered and exited several markets in Europe and Latin America. Such moves may have prompted Tiger Management to dramatically reduce its Sea Limited holdings.

Fortunately, this focus seems to have changed, at least when it comes to e-commerce. Since that time, Sea Limited has focused on its home region of Southeast Asia, investing in logistics to bolster its competitive advantage. Similar moves served Amazon and MercadoLibre well and may have also inspired Coleman to buy back Sea Limited shares in his fund.

Sea Limited by the numbers

Indeed, that improvement has appeared in the financials. Sea Limited's revenue for the first quarter of 2024 of $3.7 billion increased 27% versus the year-ago quarter. This included a 33% revenue boost for Shopee and 21% for SeaMoney, the digital financial services segment. The company also limited Garena's revenue decline to 15% for Q1, a notable improvement considering Garena's 44% year-over-year revenue drop in 2023.

Furthermore, investors largely dismissed the 34% rise in the cost of revenue, despite that leading to a net loss attributable to shareholders of $24 million.

Additionally, Sea Limited forecast double-digit revenue growth to continue for 2024. The company added that the prediction did not count a possible relaunch of Free Fire in India, a factor that bodes well for Garena given its recent struggles.

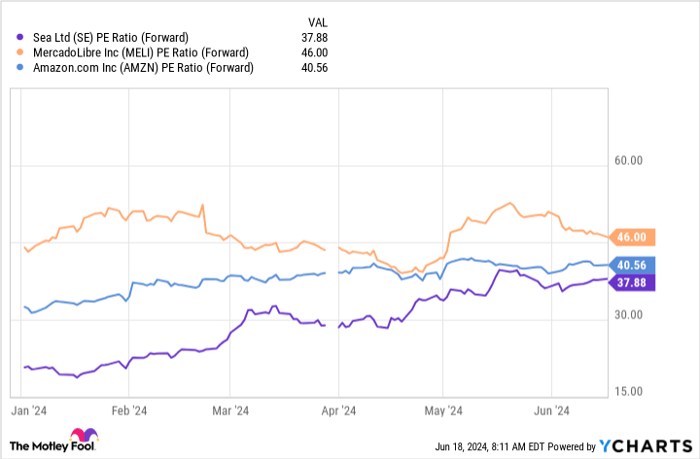

Amid better business conditions, Sea Limited stock has risen 85% since the beginning of 2024. Also, its forward P/E ratio gives it a slightly lower forward earnings multiple than either Amazon or MercadoLibre. With such improvements, one can understand Coleman's renewed interest in the company.

SE PE Ratio (Forward) data by YCharts

Should I follow Tiger Management's lead?

Ultimately, internal and external factors increase the likelihood that Sea Limited will become one of the world's premier e-commerce conglomerates.

Admittedly, a loss of focus on e-commerce and the reduced gaming revenue were troubling signs for Sea Limited, and investors like Coleman began to question whether Sea Limited was an excellent investment. Fortunately, management has steered its focus to increasing its competitive advantage in e-commerce and recovering interest in gaming, factors that could make it a top company in Southeast Asia.

Not surprisingly, Tiger Management increased its stake in the entertainment stock after this happened. Considering where the stock currently trades, investors are likely not too late to follow the lead of Coleman and his team.Should you invest $1,000 in Sea Limited right now?

Before you buy stock in Sea Limited, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sea Limited wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Will Healy has positions in MercadoLibre and Sea Limited. The Motley Fool has positions in and recommends Amazon, MercadoLibre, Meta Platforms, Microsoft, and Sea Limited. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings