5 Reasons to Buy Nike Stock Like There's No Tomorrow

Sports apparel giant Nike (NYSE: NKE) is one of the world's most recognizable brands. However, the stock has fallen to multi-year lows after a rough earnings report, and naysayers are coming out of the woodwork to proclaim that Nike no longer has enough brand appeal to retain its apparel and footwear crown.

Is that true? I don't think so. Time will ultimately reveal the truth, but there is plenty of evidence that Nike stock will eventually be back in a big way.

Here are five reasons long-term investors should be scooping up shares of the Swoosh today.

1. Nike still dominates professional sports

Nike's competitive moat starts and ends with its branding. The truth is that Nike faces an ocean of competition because there is nothing overly unique about shoes or clothing. However, that Swoosh logo is why people generally pay more for Nike's products than other brands. Visibility builds brand power, and Nike is unmatched here.

Consider just how dominant Nike is on the global sporting stage. The brand sponsors the best athletes, from established legends like Michael Jordan and Cristiano Ronaldo to up-and-coming stars like Caitlin Clark and Victor Wembanyama. Nike is the official uniform brand for three of North America's four major sports leagues. And believe me, you'll see the Swoosh throughout this Summer's Olympics. No brand has this much exposure.

2. Nike has unrivaled distribution and reach

Sports are a cultural staple worldwide, and Nike is arguably better than any apparel company in getting products to customers wherever they are. Nike is a global company with over half its revenue outside North America. Its presence in large emerging markets like India and China is a long-term growth opportunity.

Nike has also benefited from the shift toward e-commerce. Today, Nike's direct-to-consumer sales channel is almost as big as its wholesale business. Selling directly to consumers is better for profit margins because there's no middle person, and it helps Nike connect with customers. The company's smartphone app has over 500 million users.

3. Nike has sparkling financials

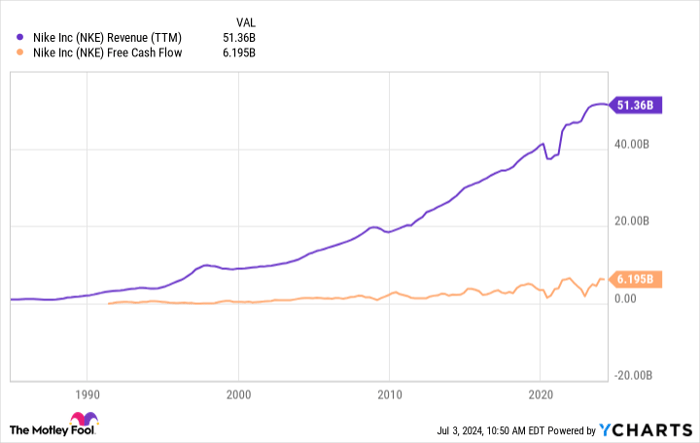

Nike uses its deep pockets to protect its brand. The company is a financial juggernaut that generates over $51 billion in annual sales and over $6 billion in free cash flow. That's enough cash flow to outspend the competition for the best sponsorships and still build its cash pile to over $11.5 billion.

NKE Revenue (TTM) data by YCharts

Notably, Nike's debt is only 1.3x its EBITDA, which acts as a financial safety net when the business hits an unexpected hiccup. As you can see in the chart, Nike hasn't had too many of those outside of the pandemic.

4. Nike is generous to shareholders

Like many great businesses, Nike generates more profits than they know what to do with. So, Nike wisely returns many of those profits to investors via share repurchases and dividends. Nike has paid and raised its dividend for 23 years and has bought back enough stock to lower its share count by over 37%. Fewer shares help boost earnings-per-share growth, which ultimately supports higher share prices.

NKE Dividend data by YCharts

Despite the doom and gloom in the share price, Nike should continue shoveling cash into shareholders' pockets. The dividend payout ratio is only 44% of its estimated 2024 earnings, which leaves money left to continue share repurchases.

5. Nike has a share price that makes sense

Is Nike perfect? No.

Management believes sales will decline next year by a mid-single-digit percentage. So clearly, Nike has lost its growth momentum. However, zoom out, and you'll see that Nike's revenue has grown nearly 30% these past five years. It's very premature to say that Nike has lost its edge. Sure, there is competition, but that's always been there. It could be that shoppers are tightening up on spending as the economy slows down.

Every company hits bumps in the road if you wait long enough. And Nike's valuation before its recent plunge didn't leave room for adversity. But now is a different story; the stock's P/E ratio has fallen from 48 to 23. Yeah, at 50 times earnings, the company had better be darn near perfect.

Today's valuation is far more reasonable. Analysts remain optimistic about Nike, estimating annual earnings growth averaging over 12% for the next three to five years. Again, a P/E of 23 is more than fair for that growth and brand power.

As long as Nike eventually gets its groove back, this is a no-brainer buying opportunity.Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 2, 2024Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings