6 Largest Private Credit Funds in 2024

Private credit is a growing asset class that provides investors with exposure to non-publicly traded debt securities. These funds pool capital from institutional investors and invest in a variety of debt instruments, including senior loans, mezzanine debt, and high-yield bonds.

The private credit market has grown significantly in recent years as investors have sought out higher-yielding alternatives to traditional fixed-income investments, such as long-term dividend stocks. Private credit funds have outperformed public debt markets over the past decade, and they are expected to continue to grow in popularity going forward.

Here are the largest private credit funds in 2024:

Blackstone Inc. – A leading global alternative investment management firm with a diverse portfolio and significant influence in the financial world, overseeing $975B in AUM, and excelling in private credit fundraising.

KKR – A prominent global investment firm with over half a trillion dollars in AUM and a substantial track record in private credit fundraising.

EQT Partners – The largest European private credit fund with a strong emphasis on private equity and venture capital investments.

Thoma Bravo – A private credit fund that specializes in acquiring enterprise software companies, it has made a significant impact with several multi-billion-dollar acquisitions in the software industry.

The Carlyle Group – A diversified private equity firm led by Harvey Schwartz, a former executive at Goldman Sachs.

Golub Capital – A credit asset manager specializing in U.S. middle-market companies

What is a private credit fund?

A private credit fund is an investment vehicle that primarily focuses on providing financing to non-publicly traded companies and borrowers. These funds raise capital from a select group of accredited or institutional investors and then deploy that capital to extend loans or other forms of credit to businesses. Private credit funds operate in the alternative lending space, often catering to borrowers who may not easily access traditional bank loans or public debt markets.

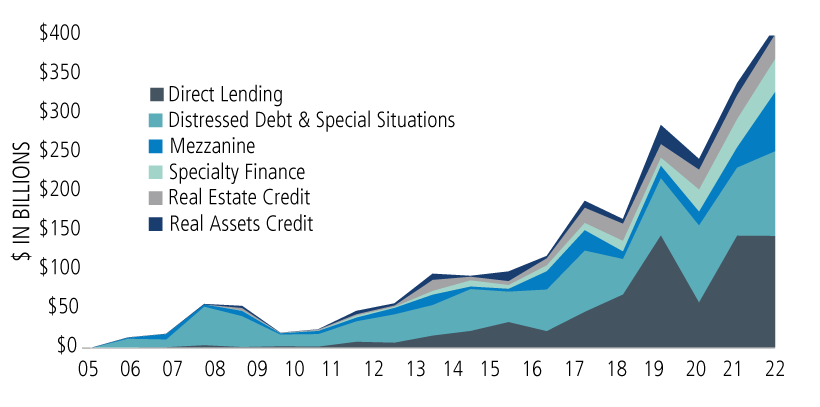

In the past 15 years, there has been a large increase in private credit, with the market surpassing $380 billion in 2022 (up from roughly $50 billion in 2007). The large increase speaks to the growing need for businesses to increase their total loan balance, bypassing traditional intermediaries, primarily banks.

Private credit capital fundraising has increased by over 600% since 2005, surpassing $380 billion in 2022. Source: Calamos Investments

What are the largest credit funds?

In the following sections, we are going to examine the largest credit funds in the world, sorted by their five-year fundraising total.

1. Blackstone Inc.

Blackstone is a global alternative investment management firm that specializes in a wide range of financial services, including private equity, real estate, hedge funds, credit, and other investment strategies. It's one of the largest and most influential firms in the world of finance, controlling $975 billion in assets under management.

According to a 2023 report from Private Equity International, a prominent data provider for the private equity industry, Blackstone raised more than $125 billion in private credit fundraising, leading all private credit funds in that regard.

Five-year fundraising total

$125.6 billion

Assets under management

$975 billion

Founded

1985

Number of employees

4695

2. KKR (Kohlberg Kravis Roberts)

Kohlberg Kravis Roberts, better known as KKR, is another well-known global investment firm that operates in the alternative investment space. KKR is primarily involved in private equity investments, but it also has a presence in various other areas, such as real estate, credit, and infrastructure investments.

KKR was founded in 1976 by Jerome Kohlberg, a Harvard Business School graduate and one of the pioneers of private equity and leveraged buyouts in the United States. As of 2023, the firm has more than half a trillion dollars in AUM, having raised over $103 billion in private credit fundraising in the last 5 years alone.

Five-year fundraising total

$103.7 billion

Assets under management

$504 billion

Founded

1976

Number of employees

4150

3. EQT Partners

EQT Partners is a global investment organization that primarily focuses on private equity and venture capital investments. It is known for its significant presence in Europe and has expanded its operations worldwide. EQT Partners manages various funds and investment strategies, covering a wide range of industries, including the private debt sector.

The firm is headquartered in Sweden and has two subsidiaries – EQT Ventures, which is focused primarily on European and US tech companies, and BPEA EQT, which is an Asian investment firm based in Hong Kong acquired by EQT Partners in 2022 for $7.5 billion.

Five-year fundraising total

$101.7 billion

Assets under management

$224 billion

Founded

1994

Number of employees

1160

4. The Carlyle Group

Founded in Washington in 1987, the Carlyle Group is a multi-faceted private equity firm operating in leveraged buyouts, growth capital, energy, energy lending, structured credit, and real estate industries. Carlyle is led by Harvey Schwartz, who received his MBA from Columbia Business School and worked as president and co-chief operating officer at Goldman Sachs (GS).

The Carlyle Group was the largest private credit fund by capital raised in 2015, according to the PEI 300 Index. While it is currently placed fifth on the list (having raised $69.7 billion in the last five years), Carlyle is still one of the largest private equity firms in the world and one of the most important players in the financial landscape.

Five-year fundraising total

$69.7 billion

Assets under management

$373 billion

Founded

1987

Number of employees

2100

5. Thoma Bravo

Thoma Bravo is a Chicago-based private equity firm that is focused primarily on acquiring enterprise software companies. Some of the multi-billion dollar acquisitions made by Thoma Bravo include Riverbed Technology ($3.6 billion), Anaplan ($10.7 billion), and Medallia ($6.4 billion).

The firm is one of the youngest companies included on our list, having been founded in 2008. However, the firm succeeded Golder Thoma & Co, which was established all the way back in 1980, which means that Thoma Bravo didn’t exactly come out of nowhere to dominate the list of largest credit funds.

Five-year fundraising total

$74.1 billion

Assets under management

$130 billion

Founded

2008

Number of employees

212

6. Golub Capital

Golub Capital is a credit asset manage that specializes in delivering reliable, long-term investment performance, prioritizing income generation and capital preservation. With over 25 years of experience, the firm has consistently focused on investing in healthy, robust U.S. middle-market companies.

The firm operates a diverse range of credit-focused investment vehicles, including private limited partnerships, business development companies (BDCs), and separately managed accounts. Golub Capital's clients include public and corporate pension plans, insurance companies, endowments, foundations, family offices and high-net-worth individuals.

Five-year fundraising total

n/a ($13.9 billion in 2023)

Assets under management

$65 billion

Founded

1994

Number of employees

875

Private credit funds FAQs

What are examples of private credit?

Private credit encompasses a broad category of non-publicly traded debt and credit instruments. Examples include:

Direct lending: Where private credit funds extend loans directly to businesses or borrowers.

Mezzanine financing: A hybrid of debt and equity, often used in private equity deals.

Distressed debt: Investing in the debt of financially troubled companies.

Structured credit: Bundled and securitized credit assets, including collateralized loan obligations (CLOs).

Do private credit funds have carry?

Yes, private credit funds can have a carried interest (carry) structure, which is calculated using APR or APY. The carry typically allows fund managers to earn a share of the profits generated by the fund after a certain threshold return has been achieved, which incentivizes managers to deliver strong returns to investors.

How are private credit funds valued?

Private credit funds are typically valued based on the fair market value of the underlying assets, such as loans or debt instruments, as determined by an independent valuation process or in accordance with fund-specific policies.

Why do investors like private credit?

Investors appreciate private credit for several reasons:

Yield potential: Private credit investments often offer higher yields compared to traditional fixed-income assets, such as long-term dividend stocks.

Portfolio diversification: Private credit can diversify investment portfolios, potentially reducing risk.

Tailored risk-return profile: Investors can choose from a range of private credit strategies to match their risk appetite and return expectations.

What is another name for private credit?

Private credit is also known as private debt, and the terms are often used interchangeably in the finance industry.

Is private credit the same as debt?

Private credit is a subset of debt, but it differs in terms of its characteristics and where it resides in the financial markets. Debt can include publicly traded bonds and loans, while private credit refers to non-publicly traded debt and credit instruments, often extended by private credit funds or alternative lenders.

The bottom line: Private credit fundraising is on the rise

Private credit is an essential part of the modern financial system, allowing companies to take out loans without going to traditional intermediaries like banks. In the past couple of years, the popularity of private debt has increased severalfold, driving significant profits for private equity firms and increasing their AUM balances.

The allure of private credit has been especially apparent in the last two years, with interest rates pushing mortgage rates to multi-decade highs. While it’s true that private credit has become more expensive due to interest rates, it generally offers more flexibility than loans offered by banks (with some of the banks using downright criminal business practices).

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings