Is It Too Late to Buy Supermicro Stock?

Super Micro Computer (NASDAQ: SMCI) has been building server systems for 30 years. Some of the world's most powerful supercomputers come from Supermicro's factories, and the company is a leading maker of high-efficiency systems for training and running advanced artificial intelligence (AI) services.

The AI boom has been very kind to Supermicro and its investors. The stock has gained 779% in two years, outperforming even AI chip giant Nvidia (NASDAQ: NVDA). Can this skyrocketing stock fly any higher, or is it already too late to invest in Supermicro?

Supermicro by the numbers

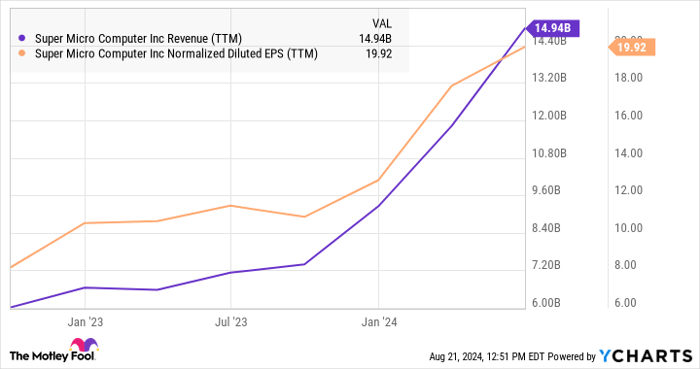

The stock is soaring for good reason. Supermicro's trailing sales are up by 144% in two years, dating back to just before OpenAI launched its revolutionary ChatGPT service. Adjusted earnings rose 148% over the same period:

SMCI Revenue (TTM) data by YCharts

Thanks to the soaring financials, Supermicro's stock still looks fairly affordable. Shares are changing hands at 31 times trailing earnings and 2.4 times sales -- not exactly bargain-bin material but those valuation ratios are far below Nvidia's.

Moreover, Supermicro's management expects its high-octane sales growth to persist in the recently started fiscal year 2025. Revenues should rise by approximately 88% this year. That's down from 110% in the 2024 fiscal year that ended on June 30, but still an impressive growth projection for a company with $14.9 billion in annual sales. Behind this bullish trend, you'll find customers embracing Supermicro's modular system designs and ultra-efficient liquid cooling systems. The company is becoming the go-to solutions for IT shops seeking high-performance computing solutions with modest electric power draws and efficient cooling.

Supermicro's reinvestment strategy

Supermicro isn't resting on its AI laurels. The company is reinvesting its recent profit streams into forward-looking growth drivers. Fourth-quarter operating costs rose by 38% year over year as Supermicro hired and trained more engineers. Capital expenses quadrupled because of generous upgrades to Supermicro's manufacturing facilities.

The forward-looking infrastructure improvements come with some uncomfortable short-term effects. Supermicro's warehouses are bulging with $4.4 billion of inventories, up from $1.4 billion a year ago. Together with the high operating costs and capital expenses, free cash flows are deeply negative right now:

SMCI Free Cash Flow data by YCharts

That's enough to keep some investors away from Supermicro's stock. However, the company has $1.7 billion of cash reserves to provide a resilient cash cushion while applying a financial laser focus on the AI-driven market opportunity. Golden ages like this one don't come around too often, and it would be a shame to give up on the next few years of potential gains just because it's expensive in the short term. I like companies willing to face temporary costs to build a better long-term future.

You didn't miss the Supermicro train yet

Supermicro's growth story is firing on all cylinders. The company is pocketing massive sales growth and profits today, and management chooses to invest that windfall in taking full advantage of this rare opportunity. The stock is soaring but still reasonably affordable, and that's another unusual combination.

Nobody saw this spike coming from a relatively sleepy systems builder, but Supermicro is taking full advantage of this golden age. If you're looking for a direct bet on hardware providers in the AI industry, Supermicro's stock offers a more affordable entry point than Nvidia's nosebleed-inducing valuation ratios. Supermicro isn't my favorite AI investment right now, but it's hard to find a better idea on the hardware side of this boom.Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings