Is Intel Stock a Buy?

The tech market has delivered impressive growth over the past year. The S&P 500 has hit record highs multiple times, fueled primarily by investors' excitement over this industry. However, despite its massive long-term potential, one company has been glaringly left out of the rally.

Shares in Intel (NASDAQ: INTC) have plunged 38% since Jan. 1, reflecting a loss of faith from Wall Street. Over the last decade, the company has faced repeated challenges, including lost market share in central processing units (CPUs), an economic downturn in 2022 that led to steep financial declines, and costly restructuring.

Yet, recent quarterly earnings and a shift in its business model suggest a recovery could be underway for Intel. Growth in the company's free cash flow and an expansion in its manufacturing division could spell a lucrative future for the chipmaker, with now potentially your chance to get in on the ground floor.

So, here's why Intel is a screaming buy this June.

Offering competitive price-to-performance in AI chips

All eyes have been on chip stocks this year alongside a boom in artificial intelligence (AI). High-powered chips like graphics processing units (GPUs) are capable of running the intensive workloads that come along with training AI models. As a result, GPU demand has skyrocketed over the last year, which has seen market leader Nvidia's stock and earnings similarly expand. Its share price has risen 210% in the last 12 months.

Nvidia's success has motivated other chip companies to launch competing AI products, including Intel. Earlier this year, Intel debuted its Gaudi 3 accelerator, promising "50% on average better inference and 40% on average better power efficiency than Nvidia H100 -- at a fraction of the cost."

According to Tom's Hardware, Intel's Gaudi 3 chips cost about $15,650, roughly half of Nvidia's H100 for $30,000. As an underdog in the market, Intel is attempting to undercut Nvidia and attract companies to its hardware. If the company can offer competitive price-to-performance, it could have a decent chance at achieving a lucrative role in the budding AI industry.

Intel is taking back the top spot in manufacturing

Intel was once the biggest name in chip manufacturing but lost out to Taiwan Semiconductor Manufacturing just over a decade ago. However, recent headwinds have forced Intel to rethink its business model and reprioritize the foundry industry.

Allied Market Research shows the semiconductor foundry market was valued at $107 billion in 2022 and is projected to more than double to $232 billion by 2032. Meanwhile, Intel is sinking billions into opening chip plants throughout the U.S. and abroad.

The company has attracted prominent investors in its venture, including private equity firm Apollo, Brookfield Infrastructure, and the U.S. government as a leading recipient in President Biden's CHIPs Act -- an initiative created to expand the U.S.'s foundry capacity.

Intel's priority on manufacturing strengthens its outlook in AI as it potentially sets it apart from companies like Nvidia and AMD, which are mainly focused on design. Intel's shift to a foundry model could see it become a leading AI chip manufacturer, profiting from increased demand across the industry.

CEO Pat Gelsinger said earlier this month that the company wants to build "everybody's AI chips" and expects its coming Ohio plant to become the AI fab of the nation.

Manufacturing takes a hefty investment upfront, indicating it could take years before Intel begins enjoying the fruit of its labors. However, the move could make its stock an excellent long-term buy, especially now while it's trading at one of its lowest prices in years.

One of the best-valued ways to invest in AI

The AI market's meteoric rise has pumped up stocks across the industry, raising the price of entry for new investors. However, Intel's recent dip could make its stock a bargain buy.

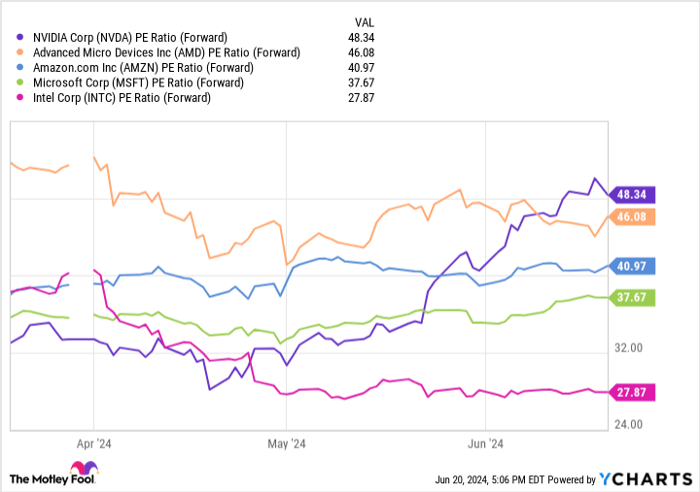

Data by YCharts

This chart shows Intel may be the best-valued stock in AI. The chipmaker's forward price-to-earnings ratio is the lowest among these companies, indicating its stock offers the most value.

With its vast potential in AI and a manufacturing business that could boost earnings for years, Intel's stock is a no-brainer right now.Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Brookfield Infrastructure Partners and Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings