Costco Vows Again to Not Raise the Price of Its Hot Dog Deal; Here's Where It Gets Its Profits Instead

Don't worry, everyone. Costco Wholesale's (NASDAQ: COST) new CFO has confirmed that the famous $1.50 hot dog and soda lunch combo is not going away anytime soon. The warehouse chain has kept the hot dog deal at the same price for close to 30 years as a way to give value back to its members. Management believes it is a great customer retention tool to keep providing that value while making a profit in other ways.

Costco clearly doesn't make money on its $1.50 hot dog deal. So how exactly does it generate a profit? Let's take a closer look and find out.

Low prices, making it up in subscription fees

Costco is famous for its low prices. You can get significant savings on basic household items even compared to other mass retailers like Amazon and Walmart. Large jars of peanut butter can be something like 30% cheaper if bought at Costco.

Investors can see these low prices with Costco's thin profit margins from merchandise sales. In its fiscal 2023, Costco generated $237.7 billion in merchandise sales, which had a cost of $212.6 billion. Add in $21.6 billion in overhead costs, and Costco earned a measly $3.5 billion in profit on $237.7 billion in retail sales, or a margin of just 1.5%.

So where does Costco make most of its money? Simple: membership subscription fees. A Costco membership is either $60 or $120 a year and comes with minimal costs for Costco. Its business strategy is essentially to sell its products at dirt-cheap prices to beat the competition and then earn a profit through high-margin subscriptions.

In 2023, Costco earned $4.6 billion on membership fees, making up over half of its $8.1 billion in operating profits. This is the most important metric for investors to track and is why Costco's net income is up 20,000% since it went public decades ago.

Incoming price hike?

The last Costco subscription hike was back in 2017. Costco has typically raised prices on its subscriptions every five to six years, making it long overdue to increase its annual membership fee. Investors are aware of this and likely expecting multiple price hikes in the coming 10 years.

Price hikes are important for Costco's earnings because they immediately fall to the bottom line. A $20 or even $50 hike could have huge implications for Costco's earnings growth over the next few years. For example, if membership revenue grows by 50% to $6.9 billion due to price hikes, this could mean a 30% increase in Costco's total operating income. And at such a reasonable price, it is unlikely many members would leave if the highest tier was raised to $150 or even $200 a year. They likely wouldn't want to give up all the value Costco provides to them through cheap retail prices.

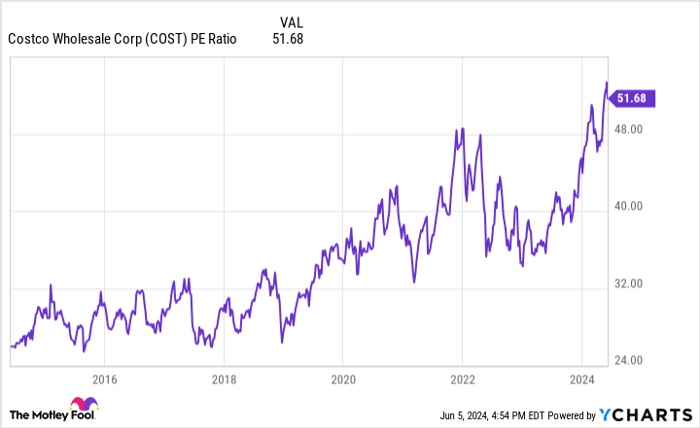

COST PE Ratio data by YCharts

The stock is pricing in a lot of earnings growth

Costco is a great business with a lot of pricing power with its membership fees. The issue is that the stock seems to be expecting these price hikes already. At a market capitalization of $370 billion, Costco trades at a price-to-earnings ratio (P/E) of 52. This is around twice the average of the S&P 500 index.

But aren't these upcoming membership price hikes not included in the trailing earnings? That is correct. Unfortunately, it is going to take a lot of membership price hikes to make the numbers work here. Even if Costco more doubles its membership revenue from 2023 -- which won't happen anytime soon -- it will generate $10 billion in annual membership revenue. Add in some low-margin retail profits, and annual earnings might hit $15 billion within five to 10 years, depending on how fast Costco raises prices.

$15 billion in earnings versus a market cap of $370 billion is a P/E of 25, or right around the market average. Investors seem to have already priced in aggressive price hikes for Costco over the next few years. It is hard to make an argument why investors should buy Costco stock at these prices.Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, and Walmart. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings