Why Warner Bros. Discovery Stock Jumped 15% This Week

There's no decisive reason the stock should be up this week. The headlines have been leaning in a bearish direction, in fact. Nevertheless, as of Friday morning, Warner Bros. Discovery (NASDAQ: WBD) shares are trading a little more than 15% higher than last Friday's close, according to data from S&P Global Market Intelligence.

What gives? Simply put, the market is making some assumptions about the media giant's future.

The thing is, these assumptions aren't crazy.

Someone finally said what many are thinking

You know the company. Warner Bros. Discovery was created via the merger of WarnerMedia with Discovery Inc., the company behind cable channels including TNT, The Food Network, CNN, Animal Planet, and, of course, The Discovery Channel. Perhaps most notably, Warner Bros. Discovery also owns streaming platform Max (formerly HBO Max).

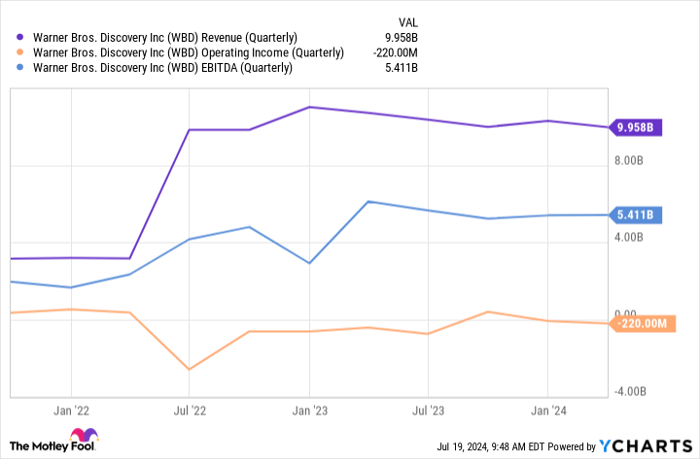

Granted, this is a tough time to be in the media business, and the TV and streaming business in particular. Streaming subscriber growth has slowed to a crawl due to market saturation, while the cable television business continues to shrink. Given all that, Warner Bros. Discovery was lucky to see its top line slip only modestly year over year in the first quarter, extending its well-established revenue stagnation.

WBD Revenue (Quarterly) data by YCharts

At the same time, the TV business is becoming increasingly expensive for middlemen like Warner Bros. Discovery. For many years, NBA games have been a core piece of TNT's programming, for instance. Now, the cable channel is being forced to bid against Amazon for the rights to air a select set of NBA games.

This bearish dynamic, however, actually evolved into a bullish one on Tuesday of this week. That's when Bank of America analyst Jessica Reif Ehrlich suggested "strategic alternatives such as asset sales, restructuring and/or mergers would create more shareholder value vs. the status quo." Investors didn't merely agree with her argument -- the market responded as if such a value-creating breakup is now likely.

Warner Bros. Discovery is still high-risk, but...

Perhaps that's precisely what's in the cards.

Even if a major restructuring or asset sale isn't in the company's foreseeable future, however, Warner Bros. Discovery shares are still arguably undervalued.

Yes, there's much to figure out here. The media giant is struggling to turn a profit in a challenging environment. For instance, even the strongest of streaming brands like Walt Disney's Hulu, Warner's Max, and Netflix are now bundling their services with those of their rivals as the fight for customer growth becomes tougher. And cable television? Forget about it. Leichtman Research reports the nation's cable TV industry shed another 5 million paying customers last year, extending a losing streak that began over a decade ago.

Warner Bros. Discovery still owns some of the most marketable brand names in the media business, however. That's something -- with or without a breakup. Between that and analysts' current consensus target price of $11.53 being 34% above the stock's present price, perhaps this week's buyers have the right idea.Should you invest $1,000 in Warner Bros. Discovery right now?

Before you buy stock in Warner Bros. Discovery, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Warner Bros. Discovery wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $741,989!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 15, 2024Bank of America is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has positions in Warner Bros. Discovery. The Motley Fool has positions in and recommends Amazon, Bank of America, Netflix, Walt Disney, and Warner Bros. Discovery. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings