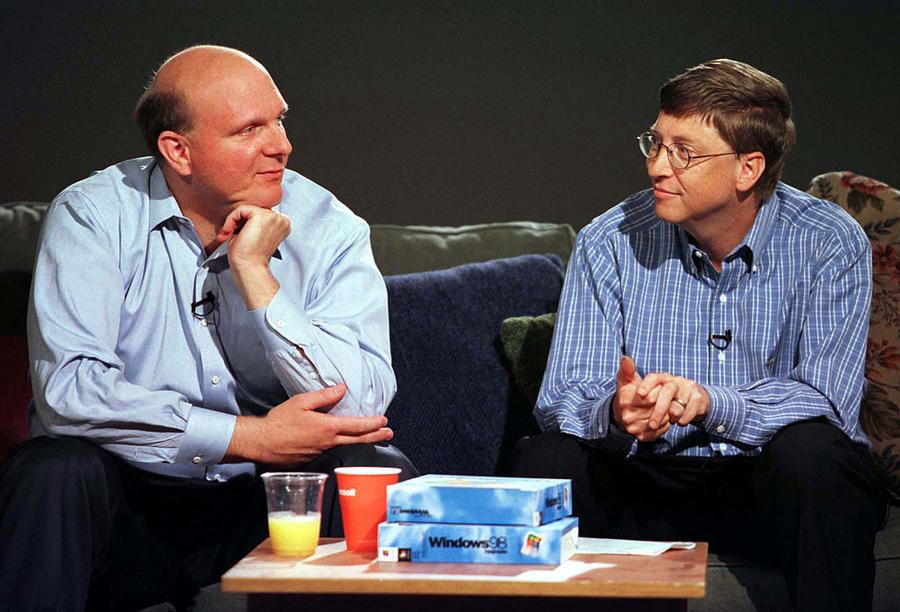

Steve Ballmer (Microsoft Employee #30) Is Now Richer Than Bill Gates

On Tuesday, something monumental happened in the upper echelons of wealth ranking. With Microsoft's stock price hitting an all-time high, Steve Ballmer became the sixth richest person in the world. But that's not actually the really the monumental event. More significantly, the stock price crossed a magic point that allowed Steve Ballmer's net worth to slightly surpass Bill Gates' net worth. The specific net worth numbers as I type this article are:

Steve Ballmer: $157 billion

Bill Gates: $156 billion

Why is this monumental? Because Steve Ballmer is not one of Microsoft's co-founders. He wasn't even an especially early employee. Microsoft was co-founded by Gates and Paul Allen in 1975. When Ballmer joined in 1980, he was employee #30. Steve lived down the hall from Bill when they were both Harvard undergrads. After graduating, he spent a few years marketing Duncan Hines Most 'n Easy cake mix for Procter & Gamble. He then enrolled at Stanford University Business School. Gates had to convince him to drop out of school and join Microsoft. He was given a salary of $50,000 per year and ZERO equity when he joined Microsoft.

To incentivize him, Gates gave Ballmer a sweetener: A 10% cut of all increase in profits. This deal would quickly prove to be unsustainable as Microsoft's profits began to explode. In exchange for giving up his profit share deal, Ballmer accepted an 8% stake in the company.

Microsoft went public in March 1986. On that day, Bill Gates owned 45% of the firm. Paul Allen owned 25%. Steve Ballmer owned 8%. The remaining 8% was made available to investors. At the end of its first day of trading as a public company, Microsoft's market cap was $780 million. Therefore, Bill ended the first day of trading with a paper net worth of $350 million, Paul was worth $195 million and Ballmer was worth $62.4 million. Also note that it would have cost you around $8 million to buy 1% of MSFT in March 1986. Today that $8 million investment would be worth $30 billion 🙂

(Photo by Jeff Chistensen)

A Financial Devastating BBQ

In 1991, Bill Gates had what might go down as the most financially devastating chance encounter in human history. Over the Fourth of July weekend, Bill's parents hosted investor Warren Buffett for a barbecue. Warren was in Seattle with a friend, and that friend was close with Bill's father, Bill Gates Sr. Bill Jr. reluctantly agreed to attend. As he would later explain:

"I didn't even want to meet Warren because I thought, 'Hey, this guy buys and sells things, and so he found imperfections in terms of markets — that's not value added to society, that's a zero-sum game that is almost parasitic."

His attitude quickly changed after Warren peppered him with "amazingly good questions that nobody had ever asked." They hit it off, and a lifelong friendship and future mutual devotion to philanthropy was born.

So why was this the most financially devastating chance encounter in human history? Because, following Warren's advice (which was certainly wise at the time), Bill proceeded to enact a plan to drastically diversify his fortune.

By 2000, the year he retired as CEO, Bill Gates had reduced his Microsoft stake from 45% to 14%. Today, Bill owns around 1.3% of Microsoft. Had Bill not been quite so aggressive in his diversification and had only reduced his stake from 45% in 1991 to 30% today, in January 2024 he would have become the world's first trillionaire. And if owning 30% of Microsoft sounds unrealistic, Larry Ellison owns 42% of Oracle. Oracle went public exactly one day before Microsoft in 1986.

Ballmer Wins In The End

Steve took over as CEO when Bill stepped down in 2000. Ballmer was CEO until Satya Nadella took over in 2014. During Bill Gates' reign, Microsoft's peak market cap was $614 billion. That market cap was achieved on December 27, 1999, at the absolute peak of the dot-com bubble. When Steve Ballmer took over two years later, the company's market cap was around $260 billion. During Ballmer's reign, Microsoft dropped as low as $160 billion in the washout from the 2008 great recession, then peaked at $315 billion right before he handed over to Satya Nadella. In the decade under Satya, the company's market cap raced to over $1 trillion. Then $2 trillion. Today it is approaching $3.5 trillion.

Ballmer has sold some of his Microsoft shares over the decades, but he wasn't quite as aggressive as Gates. Today, Steve owns 4% of Microsoft. He is the company's largest individual shareholder. Roughly 90% of his $157 billion net worth is because of his Microsoft stake.

He also owns the NBA's LA Clippers franchise. He bought the team in 2014 for $2 billion. Today, the franchise is worth around $4.5 billion.

There's more good news for Steve.

Over the years, Steve has received around $10 billion in cash from Microsoft's quarterly dividend. And earlier this year, Microsoft announced it was increasing its annual dividend from $2.80 to $3.00 per share. That increase means Steve will now get $250 million as a dividend every quarter from Microsoft… $1 billion per year… from a company he didn't found and has not worked at in a decade. Bill Gates' annual dividend after the increase works out to around $300 million.

There is one caveat in all of this. Bill Gates' net worth today of $156 billion is AFTER he's given away around $50 billion to charity.

Read more: Steve Ballmer (Microsoft Employee #30) Is Now Richer Than Bill Gates

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings