5 Best Banks in Germany For Expats & Students [2024]

Germany is a popular destination for expats and students alike, known for its robust economy, high quality of life, and excellent educational institutions. One essential task for newcomers is finding the right bank to manage their finances.

Whether you need an account for everyday banking, savings, or international transfers, Germany offers a variety of banking options. However, finding the right bank for your needs can be a bit tricky, especially when accounting for a potential language barrier.

In this article, we are going to review the best banks in Germany for foreigners to help you make your decision easier.

List of the best banks in Germany for foreigners:

N26 – The best bank for foreigners in Germany overall

Revolut – A comprehensive digital-first banking offering

Commerzbank – A robust online and physical banking offering

Sparkasse – An extensive physical presence across Germany

DKB – The 2nd largest digital-first bank in Germany

The 5 best banks in Germany for expats and students

In the following sections, we are going to examine the best banks for foreigners living in Germany. Whether you’re a student or living in Germany for business purposes, these banks should provide a venue for managing your finances.

1. N26 – The best bank for foreigners in Germany overall

N26 is a digital bank that has revolutionized banking in Germany with its user-friendly mobile app and fee-free services. It is particularly popular among young professionals, expats, and students due to its ease of use and flexibility.

A major benefit of N26 for foreigners is the support for the English language, from the app interface to customer support. The free plan allows customers to make up to 3 ATM withdrawals per month without any fees.

Key features:

Basic accounts are free of charge, with premium options available.

Account opening can be done online in minutes without the need for a German address

3 free ATM withdrawals per month (for the free plan, more for paid plans)

Up to 4% APY on cash deposited in N26’s Savings account

Multi-currency accounts

Visit N26

2. Revolut – A comprehensive digital-first banking offering

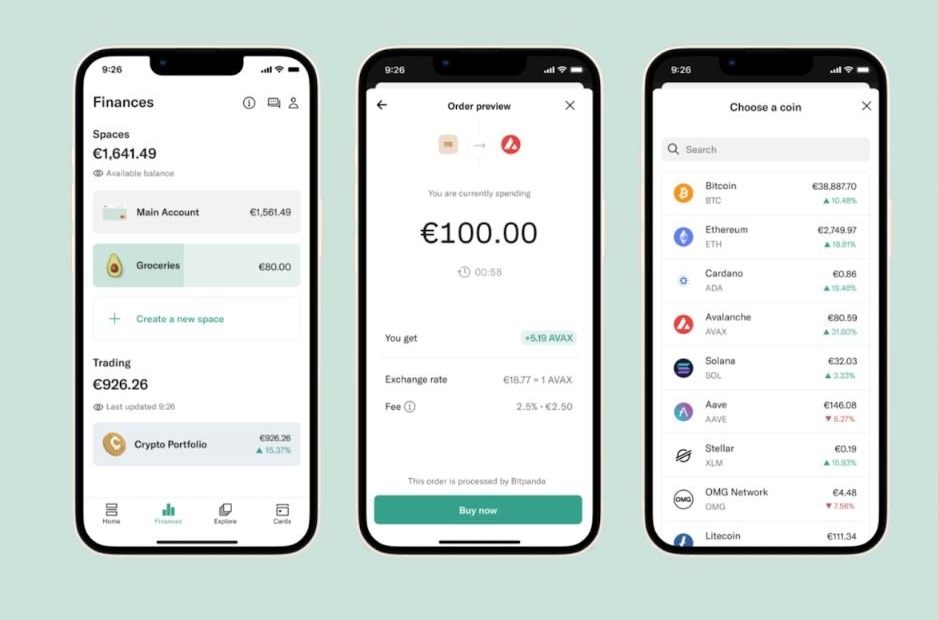

Revolut is another digital-first bank that caters to a global audience, making it an excellent choice for expats and international students. Its app-centric approach offers a range of financial services, including budgeting tools and cryptocurrency trading, making it one of the best crypto-friendly banks. If crypto trading is something you’re looking for, make sure to check how crypto is taxed in Germany.

Revolut is arguably the most feature-rich digital bank in Germany. It allows foreigners to trade crypto, earn up to 3.3% annual interest on cash deposits, and can be opened without the need for a German address. It’s also available in English, so you don’t have to worry about language barriers.

Key features:

Fee-free international payments

Hold and exchange multiple currencies at competitive rates

Integrated features to help manage and track spending

Multiple perks for paid users (5% cashback, free FT and NordVPN subscription, etc.)

3.3% APY for cash deposits for free users

Visit Revolut

3. Commerzbank – A robust online and physical banking offering

Commerzbank is one of Germany's leading banks, offering a comprehensive range of banking services. It is particularly attractive for those who prefer traditional banking with a strong digital presence. There are numerous branches of Commerzbank across the country, which makes in-person banking highly accessible.

Both the app and webpage are in English, and the bank employs English-speaking employees to provide services to their foreign customers. However, it’s worth noting that the app experience is not as streamlined as that of N26 and Revolut, which are exclusively digital-based.

Key features:

Extensive physical presence across Germany

Special accounts with no maintenance fees for students

Robust online and mobile banking platforms

Access to personalized financial advice and planning

Visit Commerzbank

4. Sparkasse – An extensive physical presence across Germany

Sparkasse is a decentralized network of 520 individual banks spread across Germany, each operating independently. It is known for its local focus and community-oriented banking services. Most banks under the Sparkasse umbrella offer free accounts for students.

While its app and webpage are available in English, finding an employee who speaks English at local branches might be a challenge, especially in smaller towns. Overall, Sparkasse is a good option for foreigners, especially for those who don’t need to handle their banking services in person.

Key features:

Numerous branches and ATMs in even the smallest towns

Accounts designed specifically for students, often with no fees

Full range of financial products, including loans and insurance

Strong ties to local communities and regional economies

Visit Sparkasse

5. DKB – The 2nd largest digital-first bank in Germany

DKB is a direct bank offering competitive rates and services that are predominantly online. It is a favorite among tech-savvy expats and students who prefer banking digitally. The bank offers its services only via electronic means.

DKB has more than 4.5 million customers. In addition to regular banking services, the bank also offers a plethora of financial products and services, including private real estate financing, brokerage services, installment lending, and savings products.

Key features:

No monthly fees for maintaining an account

Free Visa card with attractive terms

Competitive interest rates on savings accounts

Easy and cost-effective international money transfers

Visit DKB

The bottom line

The banks in this article should provide a great financial experience for foreigners living in Germany. If you are interested in digital-only banking, you can’t really go wrong with either N26, Revolut, or DKB. If you need access to physical branches, then your best bets are likely Sparkasse and Commerzbank.

If you want to check a general list of the 50 best banks in the world, make sure you read our article.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings