Can PayPal Double in 5 Years? Here's What It Would Take

In the non-investing world, PayPal Holdings (NASDAQ: PYPL) is still the king of its castle. It has an incredibly strong brand and processed over $400 billion in total payment volume in just the latest quarter alone. It's an option for payment nearly everywhere online you're shopping, and you can now do many more things beyond peer-to-peer payments on its personal finance app.

But if you're in the investing world, you know that PayPal stock has lost its luster. It's down 81% from its highs, and it's not inspiring investors with any great news about its direction.

Is PayPal's story over? Or is this a bargain opportunity hiding in plain sight? Let's see if PayPal can supercharge its growth and double in five years.

Turnarounds rarely happen

PayPal isn't the growth stock it once was. The new era of innovation in fintech means the proliferation of digital finance companies that do the same thing as PayPal, and sometimes better.

PayPal already has a significant portion of the global adult population as customers, and the trend has been that active customers are downsliding. There were 427 million in the 2024 first quarter, off from a peak of 435 million in 2022.

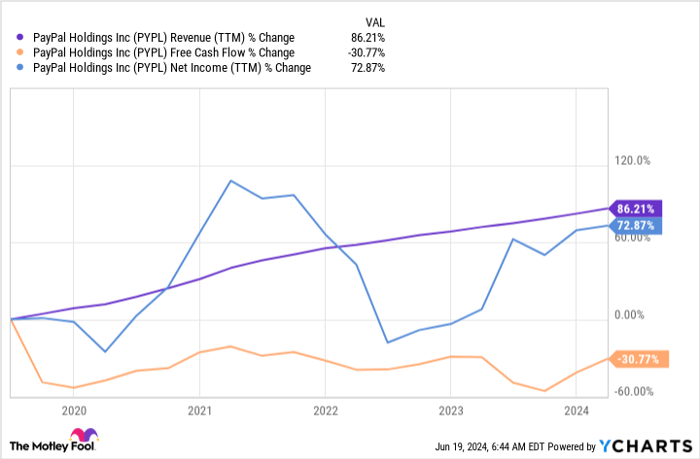

Even though sales are still rising steadily, PayPal has had struggles with generating higher net income and free cash flow.

PYPL Revenue (TTM) data by YCharts

PayPal can still rebound. It has a new CEO, and he's already remade the executive team and breathed fresh air into the company. Now, he's in the process of reinventing PayPal to leverage its brand and use its valuable assets as a growth engine.

Turnarounds are a contentious subject. They rarely happen, but when they do, investors could end up with a windfall. Some famous notable turnarounds include Apple, which fell out of favor when Steve Jobs left it, and Chipotle Mexican Grill, which was struggling before it got a new CEO.

What would it take to double?

Theoretically, it shouldn't take too much for a great growth company to double in five years. The S&P 500 itself doubled over the past five years, so it's just performing in line with the broader market. Is PayPal a great growth stock? Let's see how it could play out.

With a market cap of $62 billion, doubling would mean an increase to $124 billion in five years. Keeping the price-to-sales ratio of 2 steady, that would imply sales of $62 billion.

PayPal had revenue of $29.8 billion in 2023, and that figure increased at a compound annual growth rate (CAGR) of about 11% over the previous five years. It slowed to 8% last year, so let's use that as a CAGR over the next five years. This results in a potential revenue of $42 billion at the end of 2028. In that scenario, PayPal stock wouldn't double. However, if we increase the price-to-sales ratio to 3, it would mean sales of exactly $42 billion.

Let's see it from an earnings standpoint. PayPal's earnings per share (EPS) was $3.84 in 2023, and the stock trades at a price-to-earnings ratio of 15. Keeping that constant, EPS would need to hit $7.90 in five years to double the stock price. PayPal's EPS has been up and down over the past five years, but it's up 85% using last year's number. So, that does look doable.

Fifteen is a dirt cheap price-to-earnings multiple, and if you raised that to 20, it makes it even easier to double EPS. If PayPal does begin to earn investor confidence, that multiple is likely to rise. There are no guarantees, but it looks like a realistic possibility for PayPal to double over the next five years. However, a lot has to happen in terms of changing its trajectory and generating new opportunities.

Is it risky? The risk doesn't look high. Most of PayPal's decline has probably already happened. If you buy today, even if it doesn't take off, you likely won't be left holding the bag. And if it does take off, you could benefit in a big way. Still, it's not a sure thing, so I would only recommend PayPal stock for risk-tolerant investors.Should you invest $1,000 in PayPal right now?

Before you buy stock in PayPal, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Chipotle Mexican Grill, and PayPal. The Motley Fool recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings