Could Investing $10,000 in Nvidia Make You a Millionaire?

Successful investing is often slow and steady, but lightning strikes occasionally. Just ask investors in AI chip company Nvidia (NASDAQ: NVDA). A $10,000 investment made a decade ago would be worth over $2.6 million today. While rare, Nvidia's success shows that life-changing returns can come relatively quickly.

The million-dollar question is whether investors can still get the same type of returns from Nvidia in the future. After all, the rise of artificial intelligence (AI) is seemingly in its early innings. Nvidia enjoys a near monopoly on the chips that power the massive data centers running AI models.

While Nvidia's long-term outlook remains bright, the stock faces some obstacles in duplicating such massive returns.

Here is what investors should realistically expect from the stock.

The state of Nvidia today

The tricky thing about catching lightning in a bottle is that it's tough to do it again. A lot went right for Nvidia to generate the stock's massive returns in just a decade, which isn't very long in the grand scheme of investing. It's asking a lot to expect the same stock to go on another run like it.

Here's where Nvidia is today:

The company has grown to a market cap of roughly $3 trillion; Nvidia's trailing-12-month revenue is $80 billion. A decade ago, Nvidia was a relatively obscure company that built graphics processing chips primarily for the gaming industry. Today, Nvidia is a household name on Wall Street.

In other words, the stock isn't surprising anyone these days.

The math behind turning $10,000 into $1 million

Investors need a 100-fold return to turn $10,000 into $1 million. Nvidia faces two significant hurdles here. First, at a roughly $3 trillion valuation, it's now virtually the largest company in the world. At $3 trillion, Nvidia is nearly as big as China's entire stock market. It's worth almost an eighth of the whole U.S. economy. It's doubtful that Nvidia has the room to realistically achieve a valuation of $300 trillion in our lifetimes.

That would be three times the world's entire economic output.

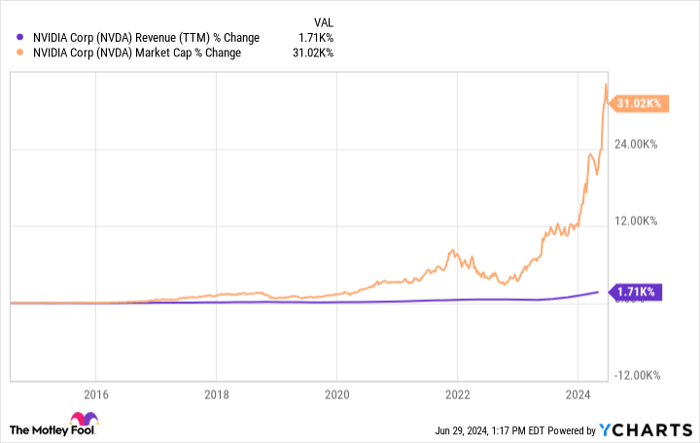

AI is a big deal and could add trillions to the economy over the years. However, Nvidia is only a piece of that growth, and the stock's $3 trillion valuation makes it clear that investors have priced a ton of that potential into today's stock price. You can see below how much Nvidia's market cap has outpaced its actual revenue:

NVDA Revenue (TTM) data by YCharts

This hasn't even touched on the potential risk of Nvidia losing its stranglehold on the AI chip market. While Nvidia has as much as 90% of the AI chip market today, it's unclear whether it can keep all of that share. Nvidia's biggest customers, big technology conglomerates like Microsoft, are developing custom chips to help power their data centers. Competitors like AMD will undoubtedly go after Nvidia.

I'm not saying that Nvidia will lose its leadership in AI. I'm saying that lightning struck once, and it's hard to see it happening again.

How Nvidia can help investors build wealth

The above math shows that Nvidia is unlikely to perform anywhere close to what it's done this past decade. However, that doesn't mean Nvidia can't contribute to your wealth-building efforts. Nvidia's surging growth from AI will generate substantial cash flows that can be used to repurchase shares and help drive earnings growth and share price gains. Analysts still believe Nvidia will grow earnings by an average of 37% annually over the next three to five years.

That could easily be a recipe for market-beating investment returns. Shares trade at a forward price to earnings ratio of 46, which is reasonable for a company growing earnings as fast as Nvidia is. So, while the ship has sailed on Nvidia being a life-changing multibagger, it can still do its part to help build wealth in a diversified portfolio.

As long as expectations remain realistic, investors should be excited to buy and hold Nvidia stock.Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $751,670!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 2, 2024Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings