Tether Charts New U.S. Course: Institutional Stablecoin and Regulatory Compliance in Focus

Tether is developing a new U.S. strategy and plans to launch an institutional stablecoin specifically for corporate clients, according to CEO Paolo Ardoino. Ardoino said in an interview with Bloomberg Television that the company’s entry into the U.S. market is already well underway.

New stablecoin for institutions

“We are actively working on developing our domestic strategy for the United States,” Ardoino said on July 23. The announcement comes less than a week after President Trump signed the GENIUS Act, which regulates stablecoins in the United States.

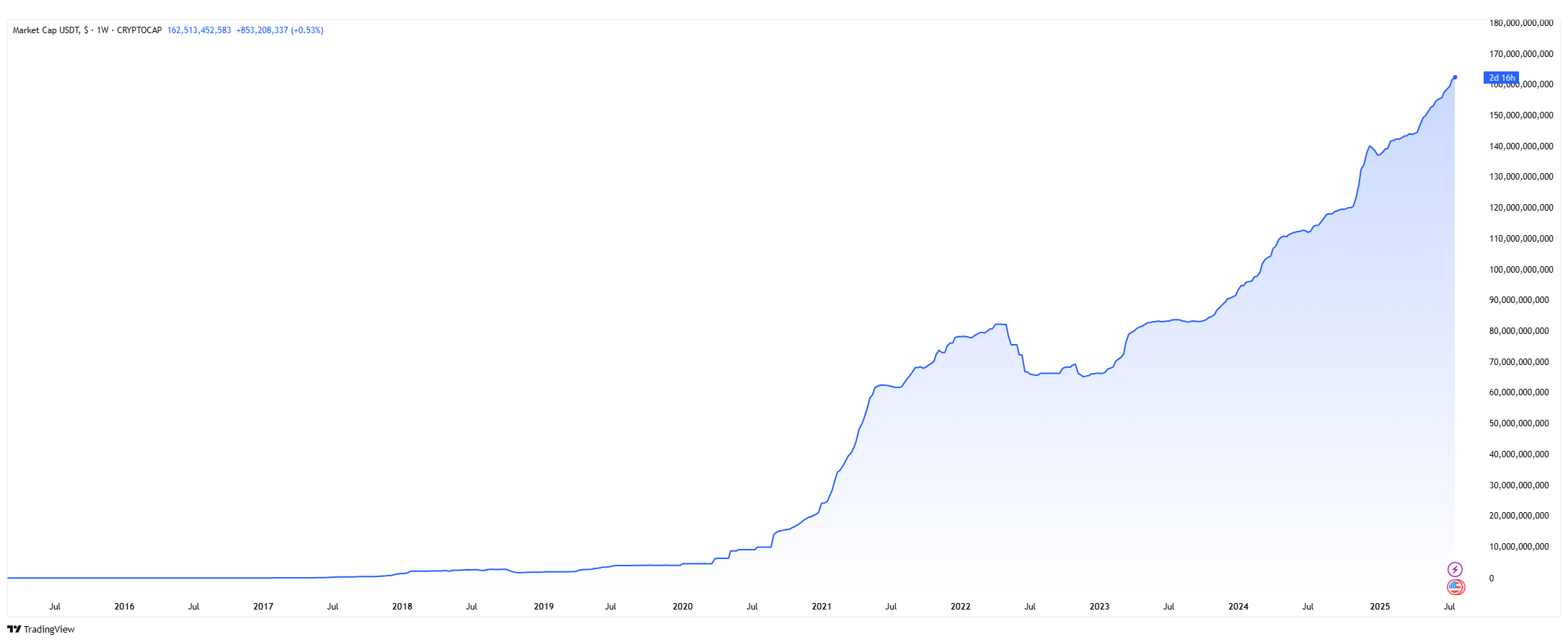

Tether’s market cap has been rapidly growing since 2021. Source: TradingView

Tether’s USDT token remains the largest stablecoin in the world, with a total market capitalization of $162 billion. The new product will be aimed at institutions that require faster settlements.

Ardoino promised to reveal the company’s specific plans for the U.S. institutional market in the coming months. “That’s already in the works,” he said. “We plan to make an announcement in the next couple of months.”

Audit challenges and new regulation

Tether has long faced criticism for not securing a full independent audit of its USDT reserves. Instead, the company publishes quarterly attestations signed by the Italian firm BDO Italia.

In March, the company hired Simon McWilliams as CFO to focus on achieving a full audit. Ardoino stated that obtaining a review from one of the Big Four accounting firms—Deloitte, EY, PwC, or KPMG—remains a “top priority.”

Ardoino attended Trump’s signing of the GENIUS Act last week in Washington, D.C. The law creates a federal regulatory framework for fiat-linked tokens. It requires stablecoins to be fully backed by U.S. dollars or similarly liquid assets and mandates annual audits for issuers with a market capitalization exceeding $50 billion. There are also new rules for foreign issuers.

Facing traditional banking competition

In the U.S., Tether may soon face competition as traditional banks—including JPMorgan, Bank of America, Citigroup, and Wells Fargo—prepare to launch their own stablecoins.

The growing stablecoin market. Source: Coinglass

Ardoino told Bloomberg that competitors might outperform Tether in the short term as the company establishes itself stateside, but said Tether has significant advantages.

“They can compete and maybe even outperform us in the short term in the U.S. simply because it’s a new market for us, but we have better technology,” he said. “We have a much better understanding of this market than anyone else.”

When asked if Tether planned to go public like its rival Circle, Ardoino replied that the company is not interested in pursuing a public listing.

eToro: Best platform for beginners and social trading

Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

Follow and copy top-performing traders with eToro’s unique social trading tools

Earn passive income with staking on popular coins like ETH, ADA, and TRX

Fully regulated in multiple jurisdictions with strong security protocols

0% commission on real stock trading and competitive spreads on crypto

30+ million registered users across 100+ countries

Get Started on eToro

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings