BitGo Files for IPO, Aiming to Join Growing List of Public Crypto Companies

Cryptocurrency custody company BitGo has filed documents to list its shares on a US stock exchange, continuing the trend of crypto industry firms entering traditional financial markets.

On July 21, BitGo announced it had filed a draft registration statement on Form S-1 with the Securities and Exchange Commission (SEC) for a proposed initial public offering of Class A shares. At the time of filing, the company had not yet determined the number of shares or the price range.

The registration statement has not yet appeared on the Securities and Exchange Commission's (SEC) EDGAR database.

Rapid growth of assets under management

BitGo is one of the largest custodians in the crypto industry, with assets under management exceeding $100 billion in the first half of 2025, up from $60 billion at the start of the year, according to Bloomberg.

The decision to pursue an IPO comes amid BitGo's active international expansion. The company recently received regulatory approval in the European Union under the Markets in Cryptoassets Act (MiCA). This approval extends BitGo's digital asset services across the entire EU.

In addition to its EU licensing, BitGo is looking to expand its presence in traditional US markets. In May, the company joined a small group of major cryptocurrency firms seeking a US banking license in anticipation of key regulatory changes.

Growing list of public crypto companies

BitGo aims to join the growing number of publicly traded digital asset companies. According to CoinGecko, there are currently 46 known publicly traded blockchain companies.

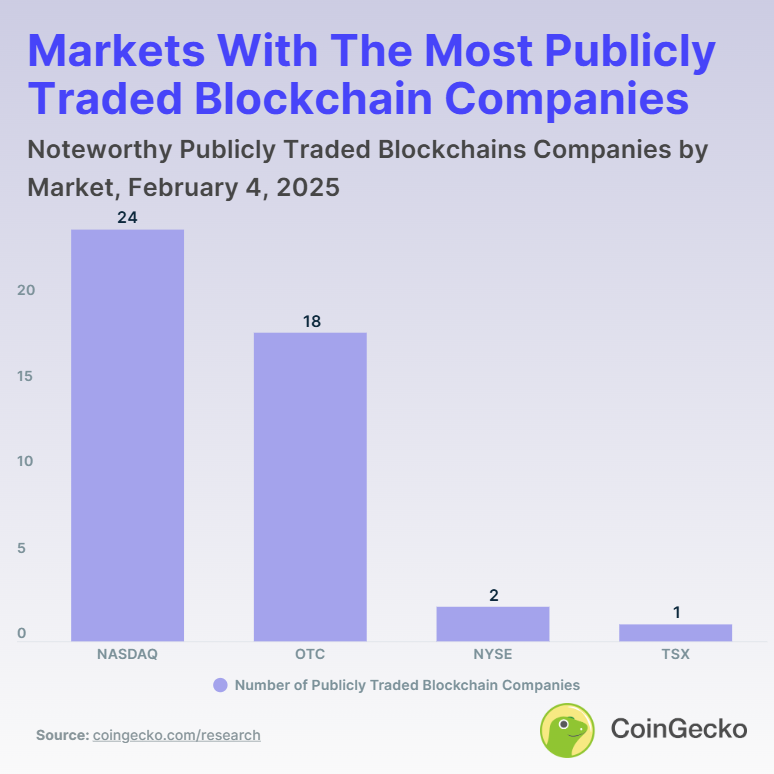

The distribution of public blockchain companies as of February 2025. Source: CoinGecko

Of these, 24 are traded on Nasdaq, 18 trade over the counter, two are listed on the New York Stock Exchange, and one is on the Toronto Stock Exchange.

Meanwhile, crypto asset manager Grayscale is also preparing for its own debut on the US stock market, having filed documents with the SEC earlier this month.

BitGo's moves reflect the crypto industry's ongoing integration with traditional financial markets. The success of the offering will depend on regulatory approval and market conditions at the time of the IPO.

eToro: Best platform for beginners and social trading

Trade cryptocurrencies, stocks, ETFs, and commodities on one easy-to-use platform

Follow and copy top-performing traders with eToro’s unique social trading tools

Earn passive income with staking on popular coins like ETH, ADA, and TRX

Fully regulated in multiple jurisdictions with strong security protocols

0% commission on real stock trading and competitive spreads on crypto

30+ million registered users across 100+ countries

Get Started on eToro

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings