Lottery Winning Taxes for different countries

Winning the lottery is a ‘dream come true’ for everyone. Gambling is a fun activity and when your number comes up you can`t avoid feeling like you are on cloud 9. Once you win the big money you want to go home with full pockets.

But that is most often not the case. The thing is that once you win, Internal Revenue Service wins as well. You see, they think of the money you won as an additional income, so in that order you have to pay taxes for the money you have won fair and square.

What you need to report depends on the amount you have won, what type of game you were playing and where you bought your ticket.

This comes as no surprise, since lotteries have been launched to raise money for the government. So, their funding is not exclusively from ticket sales but also from taxes that every winner has to pay.

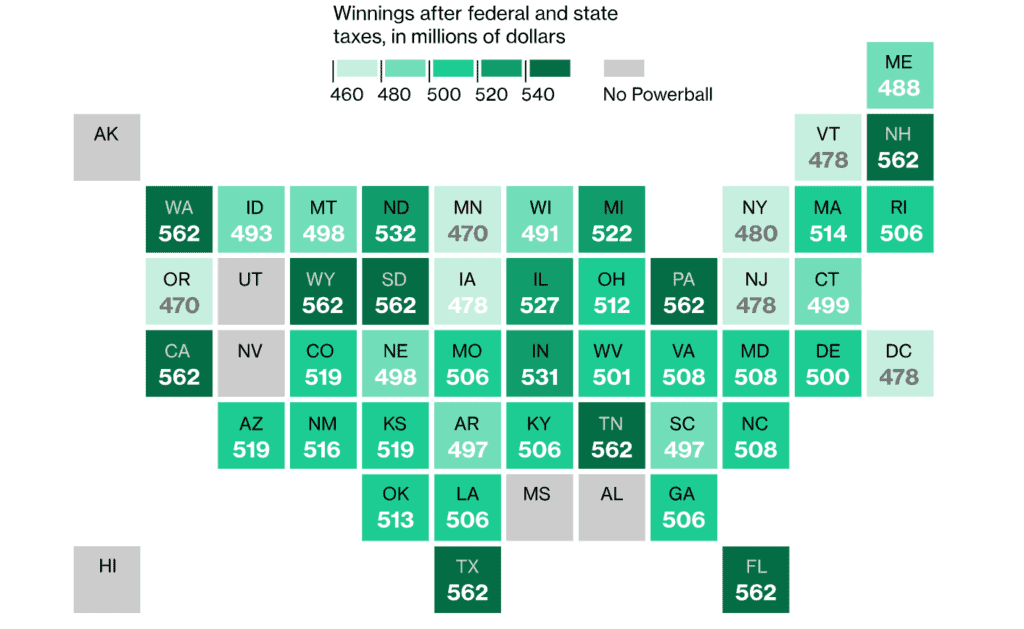

Lottery Winning Taxes for the USA

When you ask for your payout you will receive paperwork to fill in if you win $600 or more on state lottery. They will ask for your Social Security number and you will have to fill out IRS Form W-2G which is also known as ‘Certain Gambling Winnings’.

In case you win $5.000 or more you will also have to fill the above mentioned forms but they will instantly take 25 percent of your winnings. If you refuse to share your Social Security number they will take 28 percent of your winnings in accordance with federal law. The tax rates jump if you win more money too.

For instance if you are a single person who won $500.000 or more, or a couple who won $600.000 or more the tax rate is 37 percent.

Some states like Alaska, Nevada, Florida, South Dakota, New Hampshire, Texas, Wyoming and Washington don`t have income taxes. For instance you cannot buy Mega Millions tickets in Nevada or Alaska, but you can still buy them online or in other states.

California also exempts state lottery winnings from taxes, but in order for you to be eligible for the whole amount you win without taxes you need to buy the ticket in California.

Maryland and Arizona are the only states that will withhold taxes on all lottery winners, even non-residents.

Lottery Winning Taxes for Australia

The winner takes it all in Australia. Lottery winnings and other forms of gambling are not taxed at all. The only people that pay income taxes are those who punt every day and are considered professional gamblers. This means they do not have a 9 to 5 job, like other people, but they simple dedicate their time and money strictly playing the lottery and gambling in general.

They can also claim deductions for their gambling losses. This can be a tricky matter, because it can allow gamblers to claim their lost money and as we all know there are more losers than winners when it comes to gambling.

So in order to avoid that they classify professional players and take into consideration the time, the resources, frequency and whether gambling is their main source of income. This way the government protects itself from many gamblers who want to take advantage of the laws.

Lottery Winning Taxes for India

Amounts won by lottery in India are taxable under section 194B of the Income Tax Act. Everyone has to pay a tax of 30.9% on the winning amount and at the same time the lucky winner cannot benefit from their income tax rate slab, simply because this amount will not be added to their income amount.

The only exception here is if you decide to donate the money to charity. This way you don`t have to pay tax on the amount you donate for that matter.

Lottery Winning Taxes for Germany

If you win the lottery in Germany you do not have to pay tax. So if you are a lottery player then Germany seems like an ideal country for you. All the sums that are won are paid as lump sums. This may sound too good to be true, but it actually is. And as a matter of fact there are a couple of other countries in Europe that offer tax free winnings too, Austria, France, Ireland and the UK.

Lottery Winning Taxes for the UK

The National Lottery was introduced in 1994 in the United Kingdom and since then it is considered to be one of the largest in the world. And the great news is that all lottery winnings in the UK are not considered as income so that means they are tax-free. No matter of the sum or which game you played, once you win, you will receive the whole amount.

However, once you get the money there are taxes that can apply to you as well. For instance, if you deposit your money and you earn interest then Income Tax will be imposed. Also, if you make an investment that provides you with income, then you will have to pay income tax. If you want to share your winnings with your family or friends, then they will have to pay Gift Tax on the amount they receive. The same goes if you leave your money to somebody they will be imposed upon Inheritance Tax.

Lottery Winning Taxes for Russia

The tax rate in Russia goes as high as 13%. This tax rates applies to people who live most of the year in Russia, no matter if they are citizens or not. They need to stay at least 184 days in the country, and those who stay less than 184 days will have to pay tax rates of 30 %. At the same time, Russian citizens who won the lottery and paid taxes to their host country will also have to pay some percentage to their country as well.

How to take your money?

There are two ways you can take your money, lump sum payments and annuity payments. Many financial advisors will recommend you take the lump sum because that way you can invest your money and take better return.

On the other hand, taking annuity payments are a good idea since you can take advantage on tax deductions each year and you can reduce your tax bill.

Then again this all depends on many factors, such as the size of the lottery winnings, the potential rate of return on any investment, where you currently live and many more. We would suggest you to talk with a financial advisor and discuss what option will be the best for you.

Is playing lottery worth your time and money?

We have probably scared you so far with all those numbers and different rules that apply to each country. So by now you are probably wondering after all, is it all worth your time and money. Lottery tickets are usually cheap so it is good thinking to invest let`s say $5 to win potential $5 million.

This is a low-risk investment so you might as well test your luck. Even though the odds are low, somebody has to win, so that person might be you.

The post Lottery Winning Taxes for different countries appeared first on Top 10 Best Online Lotto.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings