Costco Is Behind Schedule When It Comes to 1 Important Thing: Here's What It Means for Investors

Warehouse-style retail chain Costco Wholesale (NASDAQ: COST) is a stock that investors are willing to pay up for right now. Any stock's valuation -- how expensive or cheap it is -- can be measured relative to the size of its business. And Costco's is objectively high.

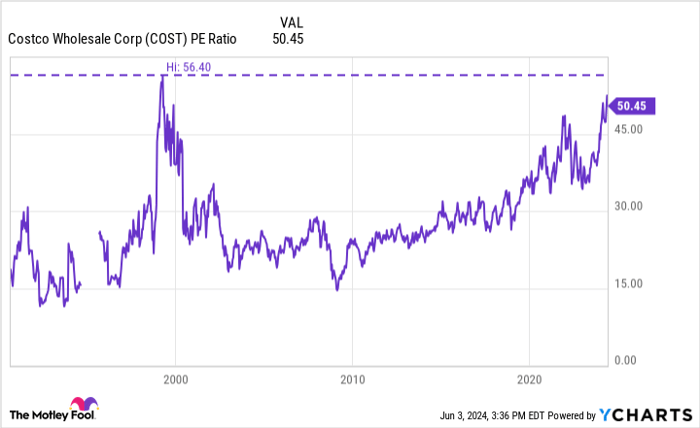

One way to value a stock is by the profits from the business. This is called the price-to-earnings (P/E) ratio. Among the hundreds of companies in the S&P 500, the average P/E is about 25, according to YCharts. However, the P/E valuation for Costco is double this at 51. This is Costco's highest valuation since the 1990s.

COST PE Ratio data by YCharts

Considering the valuation for Costco stock is at a 25-year high, shareholders may have a problem on their hands. Investors might soon decide that the stock is overvalued and they could consequently sell to take profits off the table. And if there are more sellers than buyers for the stock, then the stock price would start to fall.

There is a remedy for Costco's high P/E ratio problem. If the company's earnings increase faster than the stock does, it would bring the stock's valuation down to more normal levels. And if that happens, investors are less likely to sell on valuation concerns.

When it comes to increasing its earnings, Costco does have a powerful lever at its disposal. And the company is actually behind schedule when it comes to pulling this lever. Depending on your perspective, that could actually be a really good thing.

Costco's behind-schedule profit lever

Before I go any further, it's important to highlight an important nuance with Costco's business model. The company has annual net sales in excess of $200 billion, making it one of the largest retailers on the planet. But this is not the moneymaker for the business.

Costco is a membership-based chain. The only reason shoppers join the club is to buy products at some of the lowest prices possible. Therefore, management doesn't strive to make much money from retail sales. Through the first three quarters of its fiscal 2024, its gross profit margin for retail sales was a paltry 11%. After adding in operating expenses, Costco makes next to nothing from selling products.

By contrast, Costco makes its money by charging membership fees -- there's virtually no cost to this, making it pure profit. Through the first three quarters of 2024, the company had operating income of $6.2 billion. But revenue from membership fees was $3.3 billion. In other words, more than half of its profits came from charging these membership fees.

Therefore, when Costco increases its membership fees, it has an outsize impact on profits. And right now, the company is way behind schedule.

CFO Gary Millerchip just told investors, "We've historically looked at increasing the membership fee every five years or so." But the company last boosted the fee back in 2017. So what's keeping it from doing so right now?

Millerchip went on to say that inflation and consumers' fears about an economic recession have kept Costco from increasing its membership fees in recent years. And in its fiscal third quarter of 2024, management noted that it has a 93% renewal rate from its members. This is quite high and management doesn't want to mess this up by increasing the fees.

A pessimist might look at this and say that Costco doesn't have pricing power because it's afraid of losing customers -- that wouldn't be good. But an optimist would look at this as an opportunity to boost profits sooner rather than later. It also feels inevitable. When the time is right, management will pull the lever.

For those wondering if they should buy Costco stock today, I should point out that raising the membership fee won't grow profits enough to bring the valuation down to a reasonable level. In 2017, it raised membership fees in the U.S. by just 9%. A future raise could be similar in size and it wouldn't bring the P/E ratio all the way down to historical levels.

However, for those who are nervous about the valuation, this is simply a reminder that Costco has options when it comes to growing its profits -- I've only highlighted this one overdue option here. But there are others. Therefore, it's possible that Costco will do enough to justify its valuation before there's a valuation-motivated sell-off.Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings