The S&P 500 Hit an All-Time High in the First Half of 2024 -- Should Investors Expect a Decline to Finish the Year?

In 2022, the S&P 500 declined by over 19%, marking its worst year since 2008 during the Great Recession. Luckily, the index has bounced back since then, finishing 2023 up over 24% and now up over 15% through the first half of this year.

On June 18, the S&P 500 hit a new all-time high, topping over 5,487. This is great news for investors in the stock market's most popular and important index, but the huge gains have some investors concerned about a correction heading its way.

Whether the S&P 500 sees a decline in the back half of the year remains to be seen, but investors should keep a few things in mind.

A handful of companies leading the charge

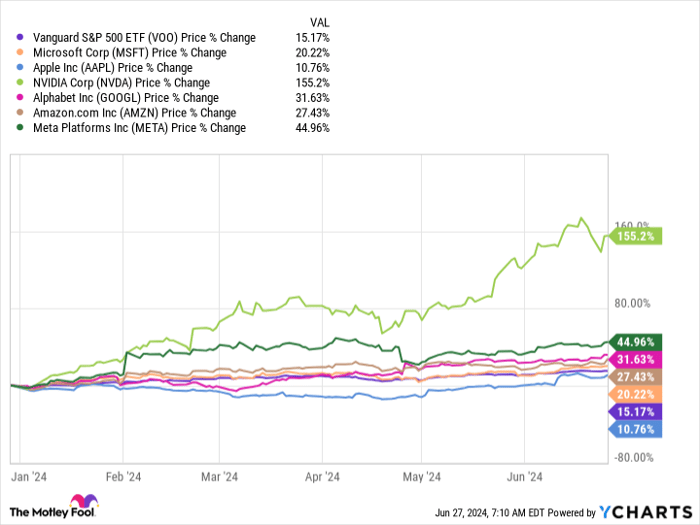

Despite containing around 500 of the U.S.'s largest companies, the S&P 500's gains so far this year can be credited to a handful of big tech stocks leading the way. Let's look at the Vanguard S&P 500 ETF (NYSEMKT: VOO), which mirrors the S&P 500. Here are the exchange-traded fund's top six holdings (as of May 31):

Microsoft: 6.95% of the ETF

Apple: 6.29%

Nvidia: 6.10%

Alphabet: 4.22%

Amazon: 3.63%

Meta Platforms: 2.31%

Together, these five companies make up just under 30% of the ETF, so their gains (or losses) can have a real effect on the S&P 500's performance. It's worked out in the index's favor, too.

VOO data by YCharts

Aside from Apple, which has lagged behind other big tech companies in stock gains, the S&P 500's top companies have all seen impressive gains this year. This is especially true for Nvidia, arguably the hottest name on the stock market for the past year or so.

If the S&P 500 wants to continue its run, much will depend on the performance of its top six holdings. The good news: Those companies each have growth opportunities that could fuel their runs further to finish out the year. The could-be-better news: A company like Nvidia may experience a pullback as investors worry about it approaching bubble territory.

History may be on investors' side

The most important thing to keep in mind is that nobody can predict how the stock market will move in the near term. Not me, you, Warren Buffett, Wall Street executives, nobody. If it were possible, there would be tons more investors raking in cash in abundance. Unfortunately, that's just not the case.

That said, there's nothing wrong with looking at history to gain insight and get a sense of trends. Below are the S&P 500's gains through the first six months of the year and how much it finished up or down at the end of the year:

Year

Returns Through First Six Months

End of the Year Returns

2023

15.91%

24.23%

2022

(20.58%)

(19.44%)

2021

14.41%

26.89%

2020

(4.04%)

16.26%

2019

17.35%

28.88%

2018

1.67%

(6.24%)

2017

8.24%

19.42%

2016

2.69%

9.54%

2015

0.20%

(0.73%)

2014

7.14%

11.39%

Data source: YCharts. Table by author.

In eight of the past 10 years, the S&P 500 has finished with better returns than it had through the first six months of the year. That's an encouraging sign of what we may be headed for to end the year, but it's far from a given.

The focus should be on consistency over timing

It's easy to look at the stock market and want to plan your investing accordingly. Whether it's holding off on investing because you anticipate a slump or rushing to put money into the market because you anticipate a surge, many people fall victim to trying to time the market.

Timing the market correctly is virtually impossible to do consistently over time, so the focus should be on consistency. One of the easiest ways to remain consistent is by dollar-cost averaging.

When you dollar-cost average, you decide on an amount you can invest and then put yourself on an investing schedule. For example, you may decide you can invest $400 monthly. From there, you can decide to divide those investments into four $100 weekly investments, two $200 bi-weekly investments, or whatever amount and frequency works best for your financial situation.

You'll make some investments when the market is up and some when it's down. The most important part is to remain consistent and trust that it'll work out over time.Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024Stefon Walters has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings