Oil Is Volatile; Here Are 3 Dividend Stocks That Protect You From That Volatility

Oil prices are notoriously volatile. Over the past year, crude oil has topped out around $90 a barrel and been down in the $60s. That volatility can have a big impact on the cash flows produced by oil companies.

However, some oil companies are better positioned to weather the oil sector's volatility. Chevron (NYSE: CVX), Enterprise Products Partners (NYSE: EPD), and Enbridge (NYSE: ENB) stand out to a few Fool.com contributors for their ability to mitigate some of the impact of volatility on their cash flows. Because of that, they're great oil dividend stocks to buy for those concerned about the sector's volatility.

Chevron is ready for the next downturn

Reuben Gregg Brewer (Chevron): West Texas Intermediate (WTI) crude prices fell to zero in 2020 thanks to the economic upheaval caused by the coronavirus pandemic. There were some technical issues around that drop, but it was a shocking reminder of how volatile energy markets can be. Chevron increased its dividend in 2020, even though the energy downturn eventually pushed its bottom line into the red. In fact, Chevron has increased its annual dividend for an impressive 37 years and counting.

If you are a conservative dividend investor who wants exposure to the energy sector, Chevron and its 4.2% dividend yield should be on your shortlist. But the dividend growth streak isn't the end of the story. You need to understand how Chevron has achieved that growth despite operating in a highly cyclical industry. The answer is by preparing for downturns before they take place.

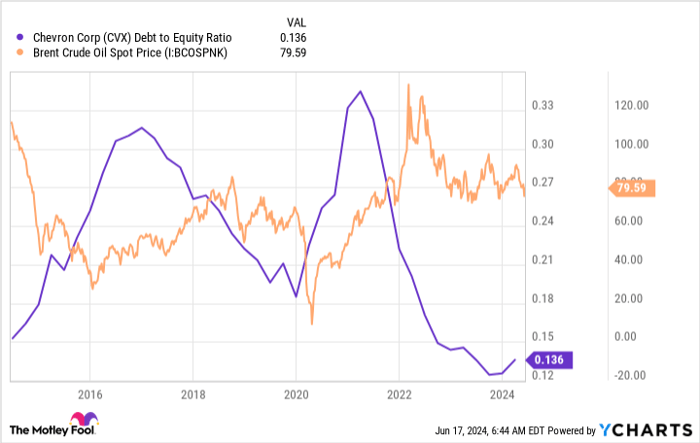

CVX Debt to Equity Ratio data by YCharts.

First, Chevron's business is diversified across the entire energy sector, from drilling through the midstream and down to the chemicals and refining. This helps to soften the blow of oil price moves since each segment performs a little differently from the others throughout the cycle.

But then there's Chevron's impressively strong balance sheet. As shown in the chart above, the company adds leverage during weak patches to continue investing in its business and paying dividends. When the market recovers, it reduces leverage to prepare for the next downturn.

Notice that the debt-to-equity ratio is currently near the lowest levels of the past decade. This means that Chevron is ready to protect investors when oil prices inevitably fall again.

A quarter century of consistency under its belt

Neha Chamaria (Enterprise Products Partners): The volatility in oil prices can be unnerving, but that shouldn't stop you from investing in energy stocks. Some energy stocks, in fact, can protect you from volatile commodity prices to a large extent and earn you solid returns over time. Case in point: Enterprise Products Partners.

Enterprise Products Partners' history reveals how resilient the oil and gas giant has been even during the most challenging times, whether for the oil markets or the economy overall. For example, the company has consistently increased its dividend for the past 25 consecutive years. That includes years like 2014-2016, when oil prices plunged, forcing some oil and gas companies to cut their dividends.

As one of the largest midstream energy companies, Enterprise Products Partners primarily generates durable cash flows under long-term, fee-based contracts. That means it continues to serve customers, storing and transporting essential raw materials like crude oil and natural gas even during an oil price slump, protecting its cash flows from volatility. To top that, Enterprise Products Partners consistently invests in its energy infrastructure to grow its cash flows to maintain a strong balance sheet and reward shareholders come what may.

With nearly $6.9 billion worth of projects currently under development, Enterprise Products Partners should be able to pay bigger dividends to its shareholders for years to come and generate strong returns regardless of where oil prices are. The oil and gas stock also yields a big 7.3%, making it a magnificent oil stock to buy and hold to protect yourself from volatility.

Built for predictability

Matt DiLallo (Enbridge): Enbridge has been remarkably resilient to oil price volatility over the years. The Canadian pipeline and utility company has nearly insulated its business from volatility by getting 98% of its earnings from stable cost-of-service agreements or fee-based contracts. Because of that, it has a very low-risk, predictable cash flow profile:

Image source: Enbridge. DCF = diversified cash flows. EBITDA = earnings before interest, taxes, depreciation, and amortization.

As that graphic shows, Enbridge has achieved its earnings guidance for 18 straight years. That consistency has come despite significant periods of oil price volatility.

Enbridge currently pays out 60% to 70% of its very stable cash flow in dividends to investors. That relatively conservative payout ratio gives it a big cushion while enabling it to retain a significant amount of cash flow to fund expansion projects. The company also has a very strong investment-grade balance sheet. These features put Enbridge's dividend (which currently yields over 7%) on an extremely firm foundation.

The company uses its retained cash and strong balance sheet to invest in expanding its operations. Enbridge currently has billions of dollars of expansion projects under construction, including new natural gas pipelines, oil storage capacity additions, natural gas utility expansions, and renewable energy projects. Enbridge will also make acquisitions as opportunities arise. It's currently working to close the final phase of a once-in-a-generation utility acquisition.

Enbridge expects its growth investments to fuel to increase in cash flow per share at a 3% annual rate through 2026 and a 5% rate after that. This earnings growth should enable it to continue increasing its dividend -- which it has done for 29 straight years -- even if oil price volatility strikes again.Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024Matt DiLallo has positions in Chevron, Enbridge, and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Chevron and Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings