Best Stock to Buy Right Now: Cava vs. Dutch Bros

Cava Group (NYSE: CAVA) and Dutch Bros (NYSE: BROS) are both fairly recent initial public offerings (IPOs) that have captured market attention. They have a lot in common, and both are reporting strong performance. But which one is the better buy today?

The case for Cava: following Chipotle's playbook

Cava operates a chain of restaurants offering healthy, Mediterranean fast-casual fare. It's popular so far, and it's been compared to mega-chain Chipotle Mexican Grill. Considering the outstanding success of Chipotle, Cava looks like it could be a great stock candidate that is just getting started.

It's only been on the market for about one year, and in the four quarters it's reported, it has demonstrated growth and increasing profits. Revenue increased 30% in the 2024 first quarter to $256 million. Comparable sales rose 2.3%, which is a sharp slowdown.

Management had said that previously high comps growth was partially due to the hype surrounding the IPO. It's decelerating as expected, especially as inflation makes its own impact. However, management is expecting comparable sales to tick up, guiding for a 5.5% increase at the midpoint for the full year.

Profitability was strong in the first quarter. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) doubled year over year to $33.3 million, and net income soared from $2.1 million to $14 million. Free cash flow was $4.7 million.

Cava opened 14 new stores for a total of 323, and it plans to open around 50 for the full year. It sees the opportunity to operate as many as 1,000 stores over the next eight years or so. Management sees a strong network effect as it scales, with each successive opening leading to more buzz, brand amplification, higher engagement, and increasing sales.

The case for Dutch Bros: following its own playbook

Dutch Bros is a coffee chain concentrated on the West Coast but expanding across the country. It can be compared to Starbucks because it does offer similar beverages, but it has cultivated a unique style and culture that's attracting loyal fans.

It has been a public company for nearly three years, and although there have been some hiccups along its journey, it's in a solid place and only getting better. Revenue increased 39% in the first quarter to $275 million, driven by a 10% increase in comparable sales. That's an important improvement, since comps growth had decelerated and even turned negative in last year's first quarter.

Adjusted EBITDA increased 120% to $52 million, and net income was $16.2 million, up from a $9.4 million loss last year. It opened 45 new stores and plans to open up to 165 for the year. It operates 876 stores right now and sees the opportunity to open as many as 4,000 stores over the next several years.

Dutch Bros recently appointed a new CEO to lead it into its next growth phase. Christine Barone is experienced in the food industry, including a stint at Starbucks, and the company is already making changes with her leadership, such as opening a new resource center in Arizona. That will impact profitability in the short run, but management sees it as an investment in its expansion efforts in the long run.

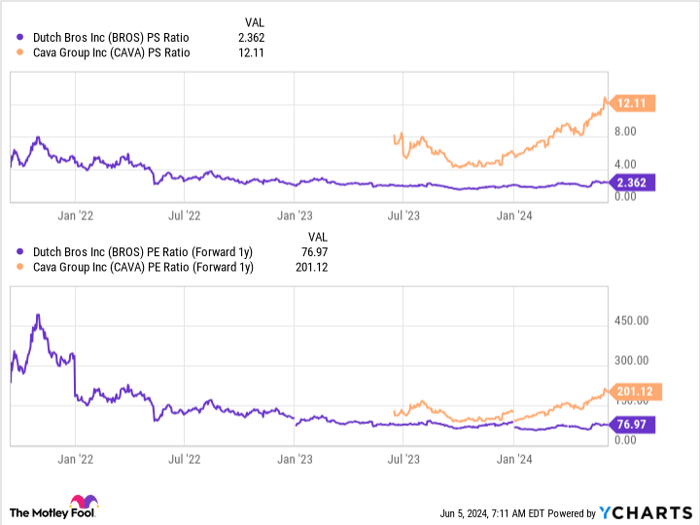

Comparing valuation

There are compelling investing theses for both of these stocks. Let's see how their stocks stack up against each other in terms of valuation.

BROS PS Ratio data by YCharts

Cava is significantly more expensive than Dutch Bros, even though Dutch Bros is growing faster and is more profitable. In the first quarter, Dutch Bros' operating margin was 9.3% vs. 1.6% for Cava.

Cava could be an excellent stock to own at some point, but if you're looking for a young restaurant stock to own now, I would recommend Dutch Bros.Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool recommends Cava Group. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings