Down 57%. Is UiPath Stock a Buy on the Dip?

A disappointing first-quarter earnings report recently wreaked havoc on UiPath's (NYSE: PATH) share price. In a single trading session, shares of the robotic process-automation specialist tanked about 35%.

Investors were responding to the abrupt dismissal of a CEO and a reduced outlook for the rest of its fiscal year.

The road ahead for UiPath might not be as smooth as anticipated, but it looks like the market may be overreacting. Shares of UiPath have been trading for about 56% below the peak it set in February.

Could UiPath be a smart stock to buy on the dip? Let's look at reasons Wall Street analysts have altered their expectations for the enterprise-software company to see if it can bounce back from recent losses.

Why UiPath stock is down

On May 29, UiPath presented results from its fiscal Q1 that ended on April 30, and they upset shareholders in more ways than one. Fiscal Q1 revenue reached expectations, but management significantly lowered its outlook for the rest of its fiscal year.

Fiscal Q2 revenue is expected to fall about 10% from Q1 levels. For the year, revenue is expected to land in a range between $1.405 billion and $1.410 billion, which is down significantly from the range the company provided a few months ago. In March, management guided fiscal 2025 revenue to a range between $1.555 billion and $1.560 billion.

Business-software sales are cyclical, but this isn't what's happening at UiPath. C3.ai is a competitor in the market for enterprise-scale software that leverages artificial intelligence to automate business processes, and it's firing on all cylinders.

While UiPath was lowering its forward outlook, C3.ai stepped on the accelerator. The company recently raised its revenue outlook to $382.5 million at the midpoint of management's guided range from $307.5 million a few months earlier. The new guidance implies a 43% year-over-year revenue gain.

UiPath's recently reduced guidance implies that C3.ai is eating its lunch. With this in mind, it's no wonder that Rob Enslin, the current CEO, exited the company on May 31. The abrupt CEO transition comes about two years after he was hired as co-CEO and about three months after he was promoted to sole CEO of the company.

How UiPath could rebound

UiPath's growth rate has decelerated, but the business is retaining existing customers. The company reported a dollar-based net-retention rate of 118% in its fiscal Q1.

A recently expanded partnership with Microsoft will help maintain strong retention rates. UiPath is launching a new integration with Copilot for Microsoft 365.

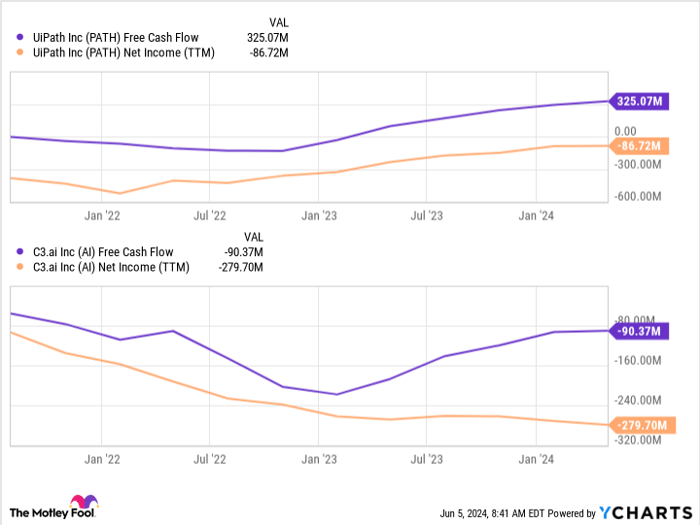

PATH Free Cash Flow data by YCharts.

Over the past 12 months, UiPath lost $87 million according to generally accepted accounting principles (GAAP), but it's already generating positive cash flows.

UiPath generated $325 million of free cash flow over the past year. On the same yardstick, C3.ai is still reporting unsustainable losses.

A buy on the dip?

After falling about 36% over the past year, UiPath stock has been trading for around 20.5 times trailing free cash flow. This is a fair price to pay for a profitable software business that is still growing.

Long-term investors who buy UiPath at its beaten-down price could reap outsized gains even if its bottom line creeps forward at a high-single-digit percentage. With plenty of businesses still coming around to the idea of automating repetitive office tasks, there's plenty of room for this business to grow. Adding some UiPath shares to a diverse portfolio now and holding them over the long run looks like a smart move for most growth-seeking investors.Should you invest $1,000 in UiPath right now?

Before you buy stock in UiPath, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $750,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024Cory Renauer has positions in UiPath. The Motley Fool has positions in and recommends Microsoft and UiPath. The Motley Fool recommends C3.ai and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings