Can Zoom Video Communications Stock Outperform the S&P 500 Over the Next 5 Years? Here's What It Would Take.

Shares of enterprise software company Zoom Video Communications (NASDAQ: ZM) are down 90% from their all-time highs. The shares continued falling during the past year, declining 19% -- a stark contrast to the S&P 500's 24% gain in that same time frame.

But can Zoom stock go up from here and outperform the market over the next five years? It does have some things in its favor.

For starters, Zoom is a financially strong company -- it would be really hard for it to go out of business. The videoconferencing specialist ended its fiscal first quarter of 2025 (which ended in April) without any debt. And it had $7.4 billion in cash, cash equivalents, and marketable securities. That's a hard ship to sink.

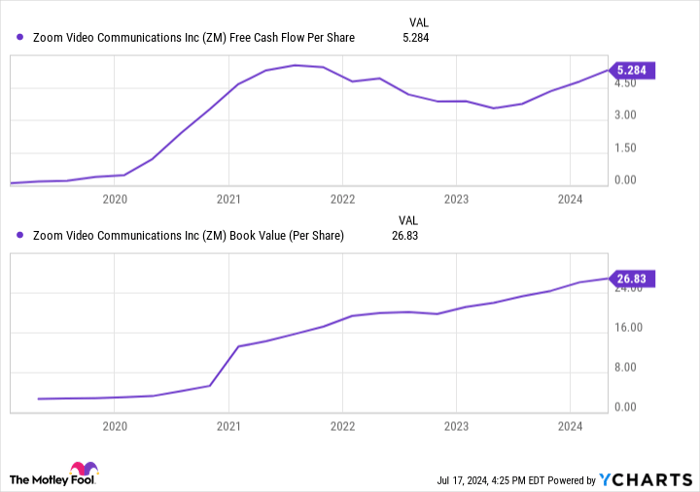

Moreover, Zoom is getting financially stronger because it's profitable. Since the company went public in 2019, its free cash flow and its book value have consistently increased. And it's not diluting its shareholders, either -- free cash flow and book value have increased on a per-share basis as well.

ZM Free Cash Flow Per Share data by YCharts

My point is that Zoom is financially strong thanks to its balance sheet and it's getting stronger thanks to its profitability. That's a good start.

Turning from its financial strength to its valuation, Zoom stock is also very cheap. The company trades at just 11 times its trailing free cash flow, while a more average valuation on the S&P 500 would be closer to 20 times free cash flow. To be fair, a cheap stock could always get cheaper. But that usually happens when business fundamentals are deteriorating. By contrast, certain financial metrics for Zoom are still climbing.

When considering the things that usually influence a stock price, profitability and valuation often have an outsize impact. These two things are in Zoom's favor. But there's an important factor that the company is lacking right now.

Here's what Zoom needs most right now

Investing firm Boston Consulting Group found that revenue growth was the biggest factor for market-beating stocks over three, five, and 10-year periods. Not all companies that expand do well on the stock market; there are exceptions to the rule. But an overwhelming number of winning stocks grow. And right now, Zoom isn't.

As with most things in investing, it's complicated. When looking at some metrics in isolation, it would seem like Zoom is growing. Looking back at its fiscal 2024, the company added 7,000 net new customers during the year. And ancillary products such as Zoom Contact Center are performing well -- it tripled its licenses for its contact center during fiscal 2024, for example.

Looking at these metrics in isolation suggest Zoom is indeed expanding successfully. But total revenue was only up 3% in fiscal 2024. It was only up 3% in Q1. And management only expects about a 2% uptick for its entire fiscal 2025. Why are things so tepid?

ZM Revenue (Quarterly YoY Growth) data by YCharts

Zoom's management has explained that many of its customers are paying for higher-tier subscription packages, which should boost revenue. However, many of these customers have also laid off some of their own workers and consequently need to pay for fewer seats. So some customers are upgrading to new products, such as contact center, but they're paying for fewer users on Zoom's core offering, which cancels out the gains.

The net result is that many metrics look good for Zoom but revenue isn't increasing at a meaningful rate.

If Zoom could return to a modest double-digit growth rate over the next five years, the stock would likely perform quite well given its financial strength and attractive valuation. But unfortunately, better growth isn't just around the corner.

For evidence, Zoom has remaining performance obligations of almost $3.7 billion as of Q1. This represents commitments from customers and it only increased by 5% year over year in the latest quarter. Moreover, 41% of these obligations are more than a year away, giving a small peek at business next year and suggesting a single-digit growth rate.

Of course, the wild card here for Zoom is that it does have more than $7 billion at its disposal to acquire or build another business. A move like that might get the top line growing again. But without a concrete plan in place, investors can't bank on this happening.

In conclusion, Zoom stock isn't a buy right now, in my opinion. Over the next couple of years, the business doesn't appear to be on track for the growth it needs to move the needle. Investors should monitor trends and plans in case things improve. But as of right now, Zoom isn't on my list of stocks most likely to beat the market over the next five years.Should you invest $1,000 in Zoom Video Communications right now?

Before you buy stock in Zoom Video Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zoom Video Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $741,989!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 15, 2024Jon Quast has positions in Zoom Video Communications. The Motley Fool has positions in and recommends Zoom Video Communications. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings