3 Reasons Coinbase Is a Star in the Making

Although it may seem premature, it's clear that Coinbase Global (NASDAQ: COIN) is already a standout performer. During the past year, its stock has surged by 350% and climbed more than 600% from its 2022 lows.

Despite this remarkable recovery, it is still about 35% below its all-time high. A closer look reveals that Coinbase has the potential to not only reclaim its previous heights, but to surpass them significantly as it reaches its full potential. Here are three compelling reasons Coinbase is a star in the making.

1. Resilience during the crypto winter

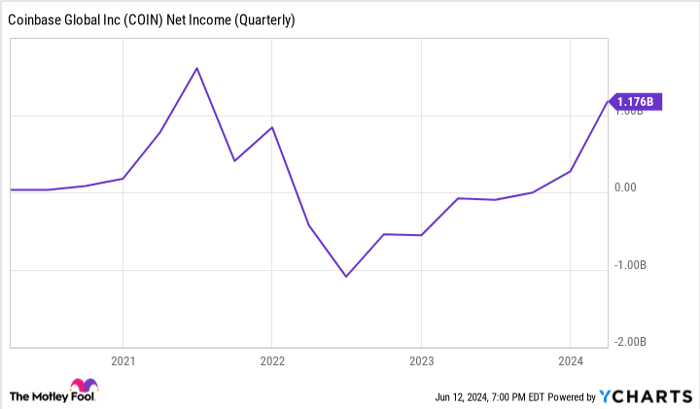

The first reason is its remarkable resilience. As the crypto winter waylaid the market in 2022, Coinbase saw its revenue and profit tumble, culminating in a net loss of $1 billion in second-quarter 2022.

However, instead of succumbing to these setbacks, Coinbase went back to the drawing board and has since emerged as a fundamentally different and stronger company. The most apparent change is its revamped business model, which now includes a diverse array of revenue-generating services.

During those tough times, Coinbase showcased fortitude, innovation, and resilience -- intangible qualities that are crucial for long-term success and characteristics that investors should prioritize. Now, Coinbase is beginning to reap the rewards, with profits reaching levels not seen since 2021. This ability to adapt and thrive under pressure underscores Coinbase's potential to keep up its pace and reward investors for years to come.

COIN Net Income (Quarterly) data by YCharts

2. Positioned in a rapidly growing industry

The second reason Coinbase is a star is its position within an industry poised for significant growth. Cryptocurrency has come a long way in the past 15 years, but it still has plenty of room to grow. It's estimated that there are about 500 million crypto users worldwide, which is comparable to the number of internet users in 2001.

Just as the internet transformed various industries and became an integral part of daily life, cryptocurrencies are on a similar path of disruption and integration. As more sectors recognize the potential of blockchain technology and cryptocurrencies, Coinbase's robust product offerings stand as a gateway for individuals and institutions beginning to explore the power of digital assets.

With such similar parallels between the growth of cryptocurrency and the internet, Coinbase's strategic positioning and established infrastructure could be compared to those of early internet giants. Just as companies like Amazon and Google leveraged the power of the internet to become household names, Coinbase has the potential to emerge as a dominant force in the realm of digital finance as the crypto market continues to mature and gain mainstream acceptance.

3. Diverse and innovative product offerings

The final and most crucial reason for Coinbase's star potential lies in its business evolution. As previously mentioned, this transformation was spurred by the recent crypto winter, which exposed one of Coinbase's vulnerabilities -- a heavy dependence on transaction fees, which plunged as crypto trading slumped. In response, Coinbase unveiled a suite of innovative products that have significantly diversified its revenue streams and proven invaluable as the crypto market regains momentum.

Among the most noteworthy products of this transformation are its staking rewards, stablecoin interest, custodial fees, institutional services, membership subscription programs, and even its own blockchain called Base. Remarkably, the company has achieved all this while reducing costs by more than 50%, even with the addition of new products.

COIN Total Expenses (Quarterly) data by YCharts

While yet to reach its full realization, this diverse array of offerings is helping Coinbase take on the shape of a modern bank powered by blockchain technology. Whether retail or institutional, users can save money, send money anywhere at any time, trade cryptocurrencies, take out loans, and much more -- all on a single platform that continues to grow by the day.

The bottom line

As its products become more robust and users become more tech-savvy (a trend particularly evident among younger generations starting to invest), Coinbase is well on its way to becoming a star and leader of portfolios.

For the long-term growth investor, there are few options on the market today that possess such a clear path for success. This isn't to say there won't be obstacles and challenges, but as crypto continues its evolution and Coinbase further refines its products, the company is well on its way to reach its goal of onboarding 1 billion users to crypto.Should you invest $1,000 in Coinbase Global right now?

Before you buy stock in Coinbase Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coinbase Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. RJ Fulton has positions in Coinbase Global. The Motley Fool has positions in and recommends Alphabet, Amazon, and Coinbase Global. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings