Viking Therapeutics Is Great. Here's Why You Shouldn't Buy It

A business can look to be in solid shape but still not necessarily be a great investment overall. A good example of that is Viking Therapeutics (NASDAQ: VKTX). The company has been doing a lot of things well lately, and there's a lot of hope and optimism around the business.

But all that may not be enough of a reason to invest in Viking Therapeutics. While the stock may look great to some investors right now, here's why it's not worth buying.

The GLP-1 market could get crowded

The bullish case around Viking's stock has to do with a promising drug it has in development, which investors are hopeful may generate billions in revenue for the business in the long run. VK2735 is a glucagon-like peptide 1 (GLP-1) receptor agonist which has shown in clinical trials that it can help people lose as much as 15% of their body weight, on average. And the pill version has also been achieving promising results in early trials.

But even if the drug obtains approval in a few years and comes to market, the GLP-1 weight-loss market could be crowded by then. Not only are there big names such as Eli Lilly and Novo Nordisk to contend with, which already have approved weight-loss drugs such as Zepbound and Wegovy, but other notable healthcare companies are also vying for a piece of the market:

Amgen may have one of the more promising drugs out there, which could pose the biggest risk for Eli Lilly and Novo Nordisk. That's because Amgen's drug, MariTide, may only need to be taken monthly (instead of weekly, which is the case for many of these treatments) while still achieving comparable results.

Roche recently unveiled encouraging results from a trial involving its GLP-1 drug, CT-338. It helped patients lose 18.8% of their weight compared to a placebo. It was a phase-one trial but an encouraging one nonetheless.

AstraZeneca has shown interest in the space as well. Last year, it agreed to pay up to $2 billion to license an experimental weight-loss drug from Eccogene, a Chinese-based company. The drug may have fewer side effects than other GLP-1 treatments.

This is still just a small sample of the number of companies Viking may need to fight with for market share in the GLP-1 market in the future. If it gets an approved product to market, that would be a great development for the business, and it looks like it may be on track for that. But that doesn't mean it will generate billions in revenue for the company right away.

Viking's valuation is just too rich

It would be one thing if Viking was a small-cap stock with a lot of upside, but Viking's already well above that threshold -- its market cap is north of $6 billion. For a company with no revenue, many investors seem to already be pricing in a lot of growth into the business. It was only a year ago that the stock was worth less than $2 billion.

The hype around its GLP-1 drug has sent the healthcare stock soaring. And that means that if it falters or investors become less optimistic about VK2735's growth prospects, shares of Viking could quickly come under pressure.

The stock's volatility is likely to continue

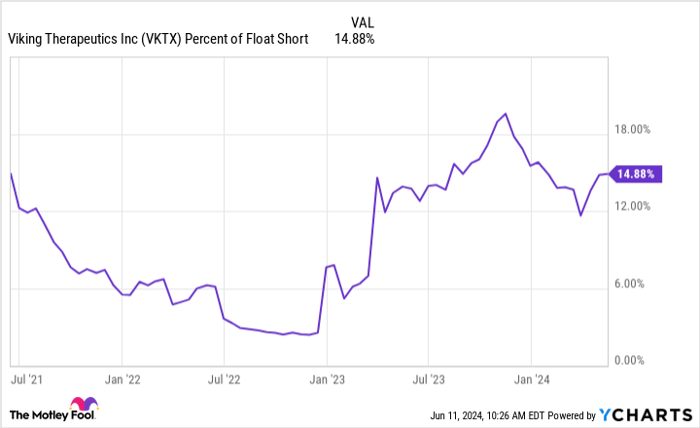

There's also the concern about Viking's short interest, which is how many people are betting against the company and expecting it to fail. Short interest, as a percentage of float, remains high at around 15%. And if the company provides investors with any additional reasons to be skeptical and concerned about the business, that short interest could rise and put downward pressure on the stock.

VKTX Percent of Float Short data by YCharts.

On the flip side, if the company posts strong results from clinical trials, there could be a short squeeze which sends its shares skyrocketing. Either way, the stock looks like a gamble right now and is likely to remain extremely volatile given its high price tag and the expectations that are baked into its valuation.

Viking Therapeutics is a highly speculative investment

Trying to predict the winners of a hotly contested GLP-1 drug market is no easy task. Viking's drug may dominate or it may get lost in the mix of a boatload of other GLP-1 weight-loss drugs. It's far too early to tell which drugs will be able to compete with Wegovy and Zepbound. Viking still has an unproven business with no revenue, and its losses will continue to accumulate until that changes.

Investors who buy Viking's stock at its current levels are effectively betting on the success of its GLP-1 drug, and that's a highly risky position to take as the stock could have a lot of room to fall if the drug fails to obtain approval or if other products look more promising.

That's why this is an investment which is only suitable for investors with a high-risk tolerance and who are OK with the possibility that they may incur significant losses. Other investors are better off staying away from the stock.Should you invest $1,000 in Viking Therapeutics right now?

Before you buy stock in Viking Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Viking Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings