3 Reasons to Buy Moderna Stock

Although Moderna (NASDAQ: MRNA) is now a somewhat famous biotech, it was a relatively unknown, clinical-stage company just five years ago. Its success in the COVID-19 vaccine market catapulted it to new heights.

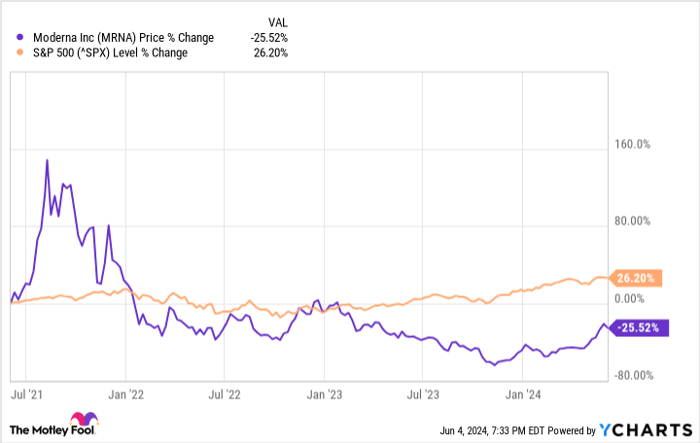

However, once the pandemic began subsiding, with a substantial decline in coronavirus-related sales, Moderna's shares suffered. They're down by 25% over the past three years. Is Moderna just a pandemic stock?

Not at all. Let's consider three reasons why investing in the company today is worth it.

MRNA data by YCharts.

1. Moderna launches its first non-COVID product

Moderna has been working hard to develop several vaccines outside its main COVID-19 franchise, and the company's efforts finally paid off. In late May, the biotech received approval from the U.S. Food and Drug Administration for mRESVIA, a vaccine for the respiratory syncytial virus (RSV).

This approval is important for at least two reasons. First, and most obviously, Moderna will no longer rely solely on its coronavirus products to generate revenue. That's a significant win for the company.

Second, though mRESVIA isn't first to market, it isn't that late to the party. The very first RSV vaccines earned approval just last year. mRESVIA is approved for people aged 60 and older, who are among the most vulnerable to RSV. For most people, this virus is relatively benign, but for seniors and those with compromised immune systems, it can lead to severe disease and death.

According to some projections, mRESVIA could generate as much as $830.5 million in annual sales by next year. While that's peanuts compared to the revenue Moderna generated from its coronavirus franchise, it's a major step in the right direction for a company moving on from the unusual success it experienced earlier in the pandemic.

2. A highly promising cancer vaccine is in the works

Another one of Moderna's candidates, an investigational vaccine called mRNA-4157, has been making solid progress. The biotech is developing this potential cancer vaccine in collaboration with the pharmaceutical giant Merck, and could hardly have found a better partner for this project. Merck is one of the leading oncology-focused drugmakers in the world, largely thanks to Keytruda, a medicine that has earned dozens of approvals for treating many different kinds of cancer.

Moderna's mRNA-4157 is currently being tested, in combination with Keytruda, in phase 3 studies. Data from phase 2 clinical trials already looks promising. Melanoma patients who received Keytruda and mRNA-4157 -- versus those who only received Keytruda -- experienced a significantly lower risk of recurrence after almost three years of follow-up. mRNA-4157 is also being developed to target patients with non-small cell lung cancer, cutaneous squamous cell carcinoma (a type of skin cancer), and more.

It will take a bit longer before mRNA-4157 earns approval; it will need to ace pivotal studies first. However, there's no denying that it would be an important addition to Moderna's portfolio.

3. Moderna's deep pipeline is a strength

Moderna's shares are down by 26% in the past three years, but the plunge could have been much worse. The company was able to stop the bleeding thanks to solid clinical progress related to not only mRESVIA and mRNA-4157, but also several other candidates it's working on. There lies one of Moderna's greatest strengths: It has a pipeline full of innovative products. It used the windfall it experienced during the earlier pandemic years to make substantial progress.

Let's consider two of the company's other pipeline programs. There's mRNA-1647, a potential vaccine for cytomegalovirus (CMV) currently in phase 3 studies. Most people are infected with CMV at some point in their lives, but it can be particularly dangerous for newborn infants and people with a weakened or compromised immune system. There are currently no approved CMV vaccines.

Then there's mRNA-1083, a potential combined COVID-influenza vaccine that Moderna also has in late-stage studies. If successful, this product could simplify the lives of millions of patients who'd rather make one trip than two to get inoculated against both dangerous viruses.

Moderna has several other exciting candidates at every stage of development. Given its recent solid clinical and regulatory developments, it's no wonder the stock is rebounding and is up by 11% in the past year. Though that still trails the S&P 500, Moderna should be able to generate solid returns for a long time to patient investors.Should you invest $1,000 in Moderna right now?

Before you buy stock in Moderna, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Moderna wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings