2 Growth Stocks That Could Go Parabolic

Growth stocks tend to experience major declines during a market downturn. This was especially evident in 2022, when the Nasdaq Composite index plunged 33% as companies faced an economic downturn.

The Nasdaq is known for its wealth of tech stocks, an industry driven by innovation with a reputation for long-term growth. As a result, many of the world's most valuable companies saw their share prices fall during the year. However, the same index has climbed 68% since Jan. 1, 2023, proving tech's ability to recover and surge if just held long enough.

Recent shifts in the industry and macroeconomic concerns have once again hit growth stocks and caused the Nasdaq to dip over the last month. Consequently, now could be an excellent time to expand your portfolio with companies that could see big gains over the next decade.

So, here are two growth stocks that could go parabolic.

1. Intel

You might be surprised to see Intel (NASDAQ: INTC) on this list. The company has arguably lost its reputation as a growth stock over the last decade, with its stock down about 40%. However, despite recent declines, Intel's stock has climbed 79,000% since it went public in 1971. Meanwhile, the past year has seen Intel carry out major restructuring moves that could make the next decade one of growth.

This August, Intel caught a lot of heat after releasing its second-quarter earnings. Revenue fell 1% year over year and missed Wall Street estimates by $150 million. Earnings came alongside news that the company would halt its fourth-quarter dividend and lay off 15% of its workforce, which didn't sit well with investors.

However, after a decade of declines, Intel's drastic and even expensive moves are necessary to turn things around. Cost-cutting measures align with the company's plan to ramp up its foundry expansion by opening chip plants throughout the U.S., a move that requires major investment. The company is currently in the processing constructing its first of at least four chip factories, with its Ohio fab set to be operational by 2027 or 2028.

Intel aims to regain the lead in chip manufacturing from Taiwan Semiconductor Manufacturing and become the world's biggest producer of AI chips. However, the plan will take time and money to come to succeed. And according to recent earnings, Intel's financial situation could get worse before it gets better. However, AI remains a major growth market that could deliver major gains for Intel, meaning owning its stock will require patience.

The company's price-to-sales (P/S) ratio currently sits at an attractive 2, indicating that its stock is a low-risk option and a bargain compared to its long-term potential to go parabolic.

2. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has a long growth history, with its stock up 476% over the last decade. The company is easily one of the most reliable long-term investments available, thanks to a deep economic moat, vast financial resources, and a powerful brand. Meanwhile, consistent reinvestment in its business means Alphabet is never still for long, furthering its positions in expanding markets like AI, cloud computing, self-driving cars, and more.

Potent products like Google, YouTube, Cloud, and Android have earned Alphabet a dominant role in tech and made the company one of the most financially stable organizations. In Q2 2024, Alphabet's net income hit $24 billion, with net margins at an impressive 28%. Meanwhile, the company's total cash, cash equivalents, and marketable securities equaled $101 billion as of June 30, further highlighting its reliability.

Moreover, Alphabet has exciting prospects in AI. The company is no stranger to the technology, using it in Search as early as 2001. AI is also a critical integration in popular products like YouTube, Gmail, Maps, and Cloud. These platforms have granted Alphabet a vast user base and a valuable tool to get its AI offerings into the hands of billions as it continues to develop its tech.

Alphabet's capital expenditures reached $13 billion this year, with much of that going toward AI. The company has the cash and brand power to keep up with its rivals and flourish in the industry over the long term.

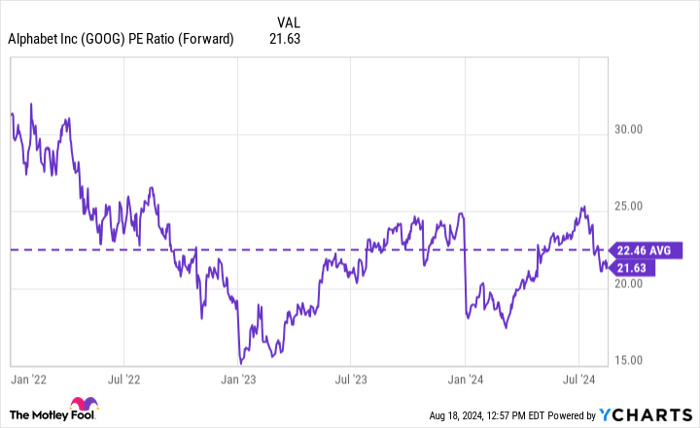

Data by YCharts

This chart shows Alphabet also boasts an attractively low forward price-to-earnings ratio (P/E) of just 22. That figure is also below its five-year average for the metric, making its stock just too good to pass up. Alongside a potent brand and financial stability, Alpahbet's stock will likely continue trending up for years.Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 22, 2024Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings