Should You Buy Ultra-High-Yield AGNC Investment While It's Below $10?

A big dividend yield can blind even the most conservative income investor to the risks of buying a particular company's shares. That's the risk today with AGNC Investment (NASDAQ: AGNC). This mortgage real estate investment trust (REIT) has an ultra-high yield that's over 14%!

But that's where the good news stops. Income investors should tread very carefully. Here's why.

AGNC Investment is a complex business

AGNC Investment is a REIT, but it isn't a traditional property-owning REIT. It buys mortgages that have been pooled into bond-like securities. Even though it is a REIT, comparing it to a property-owning REIT would be like comparing apples to oranges. Sure, they're both fruits, but they are fundamentally different in a huge number of ways.

AGNC Investment's assets trade all day, while physical properties infrequently trade hands. AGNC Investment's bond holdings almost instantly reflect the impact of interest rate changes, and property prices are often pretty sticky.

And then there are some mortgage-specific issues to consider, like repayment rates (which often vary based on the year that the mortgages in the security were issued) and housing market dynamics. It is much easier for an investor to track the underlying performance of an apartment REIT's portfolio, for example, than it would be to understand the nuances in a portfolio of mortgage bonds.

For investors looking to keep things simple, AGNC Investment will probably be a stock you'll want to avoid. But that huge yield is pretty enticing. Or is it?

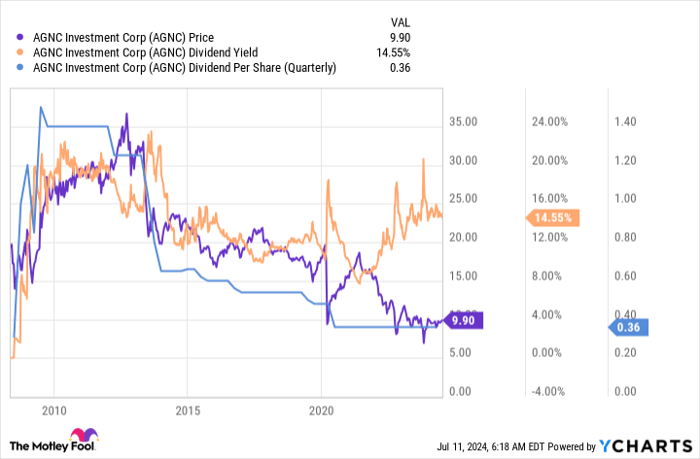

AGNC data by YCharts

The chart has a lot going on, but the first line to look at is the orange one, which is dividend yield. Notice that it has always been high, usually above 10%.

But look at the blue line, which is the dividend payment. It has been falling steadily for years. The yield has only remained high because the stock price, the purple line, has been falling along with the dividend.

If you are using your dividends to pay for living expenses, this is just about the worst possible graph you could ever see. Investors ended up with less income and less capital.

What are you paying for AGNC Investment?

Here's another fact worth knowing: AGNC Investment's tangible book value per share is around $8.90 or so. But the share price is currently around a dollar higher than that. As the chart shows, that's a historically large discrepancy. The REIT's book value is basically the value of its mortgage bond portfolio.

AGNC data by YCharts

That could change if interest rates start to fall, so some investors might be willing to overpay for AGNC Investment, given the high yield. Or that high yield could be leading less-attuned investors to pay more than they realize for a company with a long history of cutting its dividend.

If you are a dividend-focused investor, is the risk of more dividend cuts worth it? If you are wrong, history is clear that you'll end up with less income and less capital!

Most investors should pass on AGNC Investment and look at the more reliable income streams from high-yielders like Enbridge (NYSE: ENB), Enterprise Products Partners (NYSE: EPD), or even fellow REIT Realty Income (NYSE: O). All three have rewarded investors with decades of annual dividend increases.

AGNC data by YCharts

AGNC Investment is not a bad company

Here's the interesting thing: AGNC Investment actually does a fairly good job of rewarding investors when you look at total return. But that essentially requires dividends to be reinvested. That's a fundamentally different approach from what most income investors are looking for. AGNC Investment is really meant for investors, usually large ones like insurance companies and pension funds, that use an asset allocation model and look mainly at total return.

At the end of the day, despite an ultra-high dividend yield, AGNC Investment is not an income stock. If you are considering buying it while shares are below $10, but above the book value per share, you are really overpaying for an investment that might not act how you expect if you use the massive dividends it throws off to pay for living expenses.Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 15, 2024Reuben Gregg Brewer has positions in Enbridge and Realty Income. The Motley Fool has positions in and recommends Enbridge and Realty Income. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Welcome to Billionaire Club Co LLC, your gateway to a brand-new social media experience! Sign up today and dive into over 10,000 fresh daily articles and videos curated just for your enjoyment. Enjoy the ad free experience, unlimited content interactions, and get that coveted blue check verification—all for just $1 a month!

Account Frozen

Your account is frozen. You can still view content but cannot interact with it.

Please go to your settings to update your account status.

Open Profile Settings